This guide helps trustees understand their legal duties and sets out approaches to tendering for fiduciary management services.

Last updated: August 2022

Introduction

Purpose of this guidance

This guidance is for trustees of occupational pension schemes considering appointing a fiduciary management provider (FMP). The duty to tender is in relation to the appointment of in-scope FMPs as defined in the Occupational Pension Schemes (Scheme Administration) Regulations 1996 (scheme administration regulations). Also, see the terms used in this guidance for more detail. It is also for trustees of occupational pension schemes who already have one or more FMPs and are currently considering a re-tendering exercise or who will have a duty to enter into a qualifying tender process. It will also be of interest to advisers and employers.

This guidance will provide you with practical information and important matters to consider when putting together a qualifying tender process to appoint an FMP. It is intended to help trustees subject to the legal requirement carry out a qualifying tender process when selecting FMPs in relation to 20% or more of the scheme’s assets (or where this would result in 20% or more of the scheme’s assets being managed by FMP). Even where the requirement might not apply, we consider the principles outlined in this guidance to be relevant to the scheme’s governance. Trustees may consider it appropriate to carry out a qualifying tender process even when it is not legally required.

We use phrases such as the ‘law requires’ and ‘you must’ to indicate legal duties and ‘you should’ to indicate good practice approaches to meeting the requirement to run a qualifying tender process.

Potential benefits of tendering

Running a tender exercise is part of good governance. It can enable you to get value for money from service providers and help you understand the range of models and services available in the market better with a view to selecting a provider that is more likely to meet your scheme’s needs and objectives. The Competition and Markets Authority (CMA) found in its 2018 Investment Consultancy Market Investigation that trustees who tendered for fiduciary management services were more likely to pay less and receive better quality service.

Duties to carry out a competitive tender for fiduciary management appointments were introduced by the Competition and Markets Authority Investment Consultancy and Fiduciary Management Market Investigation Order 2019 (the CMA order). This is referred to as a competitive tender process in the CMA order. The Department for Work and Pensions (DWP) has updated the Occupational Pension Schemes (Scheme Administration) Regulations 1996 (the scheme administration regulations) to replace the duties placed on trustees by the CMA order. These come into force on 1 October 2022. We have updated this guidance to ensure that references to legal duties are consistent with pension legislation.

The DWP has largely replicated the requirements of the CMA order, with some alterations based on minor policy differences. You should already be complying with the CMA order requirements, which have applied since 2019. The primary change is to transfer the regulation of the obligations to tender for fiduciary management services from the CMA (under the CMA order) to TPR (under the scheme administration regulations), and trustees will be subject to TPR compliance and monitoring processes.

Contracting authorities subject to the Public Contracts Regulations 2015 or the Public Contracts (Scotland) Regulations 2015 (together with public contracts regulations) are subject to separate legal requirements when appointing FMPs.

Even if you are not subject to the legal requirement, you should consider whether it would be in the best interests of the scheme to run a tender exercise when considering fiduciary management.

After you have appointed an FMP as part of a qualifying tender process, you should review the FMP’s performance and periodically review the market to consider whether it is appropriate to run a re-tender exercise. The investment industry continues to develop and innovate. Running a re-tender exercise will enable you to check if you are still receiving good value for money and gain an awareness of new models and services available in the market. This can support an informed decision to stay with your existing provider on current terms, negotiate improved terms or switch.

Understanding your legal duties

The duties relating to FMPs contained in the scheme administration regulations only apply to relevant trust schemes, which are occupational pension schemes established under trust other than:

- schemes that are not registrable under the Pensions Act 2004

- executive pension schemes as defined in the scheme administration regulations

- relevant small schemes as defined in the scheme administration regulations

- schemes to which regulation 2(c) of the Occupational Pension Schemes (Trust and Retirement Benefits Exemption) Regulations 2005 applies

Manageable assets and the 20% asset management threshold

Manageable assets are scheme assets which could be managed by a person with a relevant delegated authority (irrespective of whether they are managed).

The ’asset management threshold’ is met where 20% or more of the manageable assets are managed by one or more FMPs to whom the scheme administration regulations apply. For the purposes of assessing if the asset management threshold is met, you do not include assets managed by FMPs to which the scheme administration regulations do not apply.

Requirement to tender for new mandates or increases in the amount of manageable assets (‘qualifying tender process’)

From 1 October 2022, for any FMP appointment (or decision to increase the amount of manageable assets) where the asset management threshold was not met prior to the appointment (or increase) but would be met after the appointment (or increase), you must:

- carry out a qualifying tender process before the appointment (or increase)

- provide the FMP with confirmation in writing that they have been selected (or there has been an increase in the amount of manageable assets managed) as a result of a qualifying tender process (a ’tender completion notice’)

A qualifying tender process means the process of inviting (and using reasonable endeavours to obtain) bids from at least three unconnected FMPs and evaluating those bids.

When carrying out a qualifying tender process, you must tender for all existing FMP appointments that have not previously been subject to a competitive tender process or under the public procurement regulations.

Existing mandates

This part of the guidance is aimed at schemes which would have met the asset management threshold before the scheme administration regulations came into force (even if not actually at the asset management threshold on the commencement date).

If you appointed one or more FMPs before 1 October 2022 that were not appointed using a competitive tender process under the CMA order1 or under the public contracts regulations and who will continue to provide fiduciary management services on and after that date, you will be required to carry out a qualifying tender process if either of the following circumstances apply:

- Immediately before 1 October 2022, the scheme met the asset management threshold and did not fall below it by the end of the ‘relevant day’ as described below.

- Either of a. or b. below applies to the scheme, regardless of whether 1. above applies:

- Articles 4.2 or 4.3 of the CMA order applied at any time before 1 October 2022 (i.e. an FMP was appointed prior to 10 June 2019 without a competitive tender process, the asset management threshold was met both on 10 June 2019 and was met immediately before the period specified in articles 4.2 or 4.3).

The period specified in article 4.2 is five years from the commencement date of the first agreement with an FMP. Where that period expired before 10 June 2019 or will expire within two years from 10 June 2019, the period specified in article 4.3 is 10 June 2021. - The scheme did not meet the asset management threshold immediately before 11 June 2019 but met it at any time beginning on 11 June 2019 and ending immediately before 10 December 2019, and one or more FMPs were appointed on or before 9 December 2019.

- Articles 4.2 or 4.3 of the CMA order applied at any time before 1 October 2022 (i.e. an FMP was appointed prior to 10 June 2019 without a competitive tender process, the asset management threshold was met both on 10 June 2019 and was met immediately before the period specified in articles 4.2 or 4.3).

In these circumstances, you will be obliged to carry out a qualifying tender process in respect of each of the scheme’s FMPs by the end of the ‘relevant day’, namely:

- If the relevant period referred to in 2.a. above has expired, the relevant day is 1 October 2022 regardless of whether the scheme also meets the asset management threshold immediately before that date.

- If the relevant period referred to in 2.a. above has not expired, the relevant day is the last day of the five-year period beginning with the day the earliest arrangement with an FMP was entered into and continues to act after the end of the relevant day.

- In any other case, the relevant day is the last day of the period of five years, beginning with the day on which the arrangements for an FMP to be reviewed or, if that period expired before 1 October 2022 or will expire within two years of then, the relevant day is 30 September 2024.

Trustees should consider the time it will take to run the tender exercise and plan ahead to ensure they complete the exercise within their deadline.

Example: Five-year period expires within two years of the commencement date of the regulations

The trustees appoint their FMP on 1 April 2019. The five-year period expires on 31 March 2024, less than two years from 1 October 2022. The trustees must complete a tender exercise no later than 30 September 2024.

Reasonable endeavours

The law requires you to invite and use reasonable endeavours to obtain bids from at least three unconnected FMPs and to evaluate the bids received. The number of providers you invite to formally tender should be proportionate to the size and complexity of your scheme. However, you should invite as many providers as is reasonable. It is likely to be prudent to approach more than three providers to ensure that you obtain the best value for your scheme and to increase the likelihood of obtaining at least three bids.

Documenting compliance

You should document the tender process you have followed, the decisions you made and the reasons why. This may include, for example, your criteria for selection, details of the process you followed to reach a shortlist of providers, key decisions made and your reasons for making them. Maintaining an audit trail will support you in demonstrating compliance with the requirement to run a qualifying tender process. Even if you are unsuccessful in receiving three independent bids, you should still document the process you followed to demonstrate that you used reasonable endeavours.

Notification to FMPs following qualifying tender process

Trustees must give a tender completion notice to any FMP who is appointed or who is given authority to manage additional assets. The tender completion notice must state either that the appointment or increase was made following the carrying out of a qualifying tender exercise or that no such tender was required.

Where an FMP is reappointed under a qualifying tender process, and their original appointment was not as a result of a qualifying tender process, trustees must also give a tender completion notice to that person. In this case, the tender completion notice must state that a qualifying tender process has been carried out under paragraph 9 of the schedule to the scheme administration regulations.

Small schemes

Trustees of smaller schemes seeking fiduciary management services should be aware that the number of providers willing to respond to invitations to tender from a small scheme may be more limited. You may wish to consider speaking to or issuing an expression of interest request to a number of providers in advance of issuing full invitations to tender to gauge the providers’ appetite to respond.

This can reduce time and resource spent on issuing invitations to tender (and potentially reviewing responses to tenders) from providers who are unlikely to respond with competitive bids and can increase your success rate in receiving bids. If you intend to use a third-party evaluator, they can support you in identifying which providers are more likely to offer fiduciary management services and competitive terms to your scheme.

Footnote for this section

[1] Where trustees have started but not completed a competitive tender exercise before 1 October 2022 in relation to any arrangements with an existing FMP and complete the exercise before the end of the relevant day, they shall be treated as having carried out a qualifying tender exercise. There are no similar provisions in relation to the public contracts regulations.

Types of fiduciary management

When considering using a fiduciary management service, you should have a clear understanding of how services might be delivered, their respective strengths and weaknesses and how the service model may differ between different providers.

There are a number of different approaches to fiduciary management, which are reflected in the range of services currently offered in the market by providers. Fiduciary management can sometimes be referred to by other names, such as ‘delegated investment consulting’, ‘implemented consulting’ or ‘outsourced Chief Investment Officer (CIO)’.

The main providers of fiduciary management services are:

- specialist/boutique firms whose sole business is based on fiduciary management services

- firms linked to investment consultants/advisory firms

- fund managers who offer fiduciary management as part of their broad product range

While fiduciary managers provide similar services, there can be significant differences in approach between firms in different market segments and within the same market segment. For example, one fiduciary management firm which is linked with an investment consultancy firm will not necessarily operate and deliver fiduciary management in the same way as another firm linked with an investment consultancy. These differences can include, for example:

- the way in which portfolios are constructed and risk is managed

- the range and management style of investments that might be included, for example some fiduciary managers may focus on actively managed alternative investments and illiquid opportunities, while others may favour a passive approach

- the holding structure for the investments. For example, some holding structures would allow the existing investments to be transferred efficiently with limited impact on value to a new investment or fiduciary manager, whereas some other structures could involve significant costs and loss of value on transfer

- the level of resource invested in fiduciary management

- the approach taken to operational risk management

- the level of ongoing strategic investment advice and training provided and the extent to which investment decisions are delegated to the fiduciary manager

- the market segment and scheme scale that is targeted

- the approach taken to the integration of environmental, social and governance (ESG) including climate impact within the investment and risk management strategies

Fiduciary management has developed in the UK over the last 15+ years. The range of services offered is continuing to develop in defined benefit (DB) and defined contribution (DC) schemes. As the market has developed, opportunities for improved mandate structuring, improved fee terms, and better mandate terms and conditions have arisen. When preparing to tender for an FMP or when reviewing your current FMP, you should have a good understanding of the current range of options available in the market and, if required, seek independent advice.

DC schemes and fiduciary management

The use of fiduciary management by DC schemes is currently limited, but the market is developing. Fiduciary management for DC schemes follows the same general principles of delegating investment powers and often focuses on the design and implementation of lifestyle funds. It can also include other services such as member investment communications.

There are several different governance structures available which involve varying levels of delegation and which, depending on their structure, may or may not meet the definition of fiduciary management.

When putting a qualifying tender process together for a DC scheme, you must use reasonable endeavours to obtain bids from at least three unconnected FMPs. The emerging DC fiduciary market is currently limited. However, the selection exercise run by the trustees does not have to be limited just to providers of fiduciary management services. You may wish to consider including providers who offer an alternative approach to DC provision to support them in choosing the most appropriate arrangement for your scheme. These alternative approaches may not meet the legal definition of fiduciary management, but they may have some comparable features.

You should document your attempts to obtain three bids from unconnected FMPs together with any other comparable products.

Find out more about fiduciary management in our guidance on choosing an investment governance model.

Investment services provided under fiduciary management mandates

The range and extent of investment services provided under a fiduciary management mandate can vary significantly, depending on the scheme governance structure, the level of assets delegated and the extent to which other advisers support the trustees. The legal frameworks vary and you may need to understand the service you are being provided with and the terms and conditions that apply to that service.

For example, the investment service provided by the fiduciary manager may be provided under a discretionary fiduciary management agreement or it may be provided separately alongside an investment advisory services agreement which is also entered into with the fiduciary manager. Alternatively, the investment service may also be split between these two types of agreement, depending on individual fiduciary manager structures and terms and conditions. Where appropriate or if the trustees are unclear, you should seek appropriate advice.

When you are receiving an investment service from an investment consultant the law requires you to set strategic investment objectives for that adviser.

Please be aware that some advice elements of fiduciary management services may be subject to the requirement to set objectives, and you may wish to consider seeking professional advice as to whether this applies in light of the services you receive.

Conflicts of interest

In appointing a fiduciary manager, you should be aware of the potential for a wide range of conflicts of interest to arise. The scale of conflicts will vary and may apply to a wide range of parties that might be involved in choosing a fiduciary manager. For example:

- the existing investment consultant may be linked directly with a firm that offers fiduciary management services or offers fiduciary management services within their wider group

- the existing investment consultant, who has no links with a firm that offers fiduciary management services, but who is retained on an advisory basis, will have a commercial interest in an advisory relationship continuing

- some fiduciary managers may actively contribute to the design of the fiduciary mandate and performance objectives. It is important for trustees to identify and challenge if they believe objectives are favourably structured or if the performance hurdles set too low

- some third party evaluators will have a commercial interest in trustees choosing fiduciary management to generate business, for example where they offer an ongoing oversight role

- other third parties will have a commercial interest in assisting with the tender exercise but may not have the necessary knowledge of the fiduciary management and investment consultancy markets within the occupational pension scheme markets to advise appropriately

Conflicts of interests may not always be a barrier to appointments or decisions being made. However, you should ensure that appropriate measures are in place to identify, mitigate and manage those conflicts. If your existing investment consultant or fiduciary manager is involved in the tendering process, you should ask them to provide, in writing, details of how the conflicts will be mitigated and managed.

Find out more about managing conflicts of interest in our conflicts of interest guidance.

Using independent third party evaluators

Once you have decided to appoint a fiduciary manager, you may wish to consider using a third party with knowledge of the fiduciary management and investment consulting markets and specific expertise in relation to evaluation of fiduciary management services and providers. The range of parties that can provide you with support on selecting an appropriate provider and running a competitive tender process is wide and there may be significant differences in the level of their existing market knowledge, research and due diligence. A third party with appropriate expertise should also support the mitigation of conflicts of interest.

While third party evaluators will add an additional cost, you may consider it a worthwhile investment, particularly if you do not have an in-house support team and if it will save you time and resources and help you to achieve a better outcome from the selection exercise. It will also help ensure that a robust process has been followed in the selection of your provider and that a clear audit trail of decisions made (and the reasons why) is prepared.

Example

The trustees of a scheme with circa £150 million assets under management appointed a third party to run a formal tender process to appoint a fiduciary manager. The third party considered the range of fiduciary management products and services available in the market and ran a tender process. They also helped the trustees to negotiate the fees and contract terms, which resulted in an improvement in the contract terms and conditions offered. After allowing for the fees charged by the third party and the general expenses of running the tender exercise this resulted in fee savings for the trustees, which were significant when considered over the expected future term of the contract.

When choosing a third party evaluator, you should be aware of their level of knowledge and understanding of the market and the services they provide. See Appendix A for examples of the main types of third party evaluators that may offer support in tendering for a fiduciary manager.

When using a third party evaluator, you should be aware of the potential for conflicts of interest to arise. You should therefore ensure that appropriate measures are in place to identify, mitigate and manage those conflicts.

Find out more in our conflicts of interest guidance.

When running any tender process, you should also consider what additional help the in-house pension team or the procurement team within the employer may be able to offer. You should be mindful of the need for specialist investment market knowledge to inform an effective tender process but may still find an in-house team are able to offer valuable support in running an effective exercise.

Key principles of a competitive tender

When selecting any adviser or service provider, you should consider running a tender exercise that is competitive to ensure that you obtain an appropriate service that best meets the needs of your scheme and delivers value for money. However, when selecting a FMP, unless you are exempt, you must run a qualifying tender process. When designing any kind of tender exercise, it is good practice for trustees to consider the key principles set out below. In applying the principles, trustees should consider the circumstances of their scheme and take a proportionate approach to the design of their process.

- Set objectives for the tender exercise: Understand what you want from a provider and how this will meet the objectives for your scheme. Make sure you have re-assessed your scheme objectives – they should be based on current analysis, relevant to your scheme circumstances and enable your longer-term objectives for the scheme to be delivered.

- Seek advice and consider appointing a third party to assist you: You may wish to consider using a third party to provide advice on the selection process. This will help manage conflicts of interest, provide in-depth insight into the current market and save time and resource in putting together a tender exercise. This will allow you to focus on the key decisions.

- Agree criteria for selection: Be clear on what you are looking for from the tender exercise and consider in advance how you will assess providers. Consider putting together a scorecard, weighting matters based on their level of importance in meeting the objectives you set for the tender exercise. Be aware that you may need to refine this, as the exercise evolves and your knowledge of the type and characteristic of the provider likely to best meet your scheme’s requirements develops.

- Seek to understand the full range of market opportunities: Understand the different options in the market and create a list of potential providers based on your objectives and criteria for selection. If you are using a third party, they will be able to support you in developing a longlist based on their market knowledge, research and due diligence.

- Select longlist of potential providers: Based on your review of the market, select a sub-set of providers and create a longlist to invite to tender. If you are using a third party, they may do this step for you and present a recommended shortlist. If this is the case, you should understand the process they followed, which providers were discounted and why.

- Seek expressions of interest: You may find it useful to contact providers before issuing a detailed invitation to tender. You could issue a short “expression of interest” request, which would include some high-level details of your scheme, your potential mandate requirements and a number of preliminary questions to gather relevant information. This would enable you to create a more focused longlist based on providers that are more likely to respond to a formal tender and are more likely to be suitable for your scheme. This step may be particularly useful for smaller schemes or schemes with specific or very specialised requirements. If you are using a third party, they are likely to do this on your behalf.

- Issue invitations to tender: Invitations to tender should focus on requesting a bespoke offering from providers that will support you in meeting the objectives you have set for the tender exercise. The invitation to tender should include a brief overview of your scheme’s current arrangements and set out the requirements for the service you are seeking. Questions in the invitation to tender should align with your agreed assessment criteria.

- Assess bids and select a shortlist: Compare the bids based on your agreed criteria, using your scorecard and select a shortlist of candidates to consider in more detail.

- Invite shortlisted providers to present their proposals: The shortlisted providers should be invited to present to the trustees. This will provide you with the opportunity to interview the candidates and discuss the services they proposed to offer in their bids in greater depth.

Trustees may also find it useful to engage with the employer at certain points during the process, for example when determining the objectives for the exercise or when deciding the requirements for the mandate to be awarded. This can help to ensure that the longer-term objectives of the employer for the scheme are better aligned with the trustees’ implementation decision. The employer may also have in-house procurement expertise, which could assist with the tender exercise.

Running a tender process will require commitment of significant time and resource from the trustees. You should make an allowance for any upcoming tender exercises in your business plan and consider what skills, resources and training you may need to achieve the best outcome. You may wish to set up a sub-committee to carry out the day-to-day activities of the tender process or to oversee a third party you commission to carry out the tender process.

How you run the process will depend on your scheme’s governance structure and any delegations that the trustee board approves. However, there will be points in the process where involvement from the full trustee board may be required, particularly where a significant decision is to be made. For example, an opportunity to attend the final presentations or meet the preferred adviser may be offered to all the trustees before the appointment is ratified.

Agree governance and level of delegation

You should understand and document the level of decision-making you want to delegate to a FMP. You should agree and set this out before tendering as it will enable you to decide which providers’ offerings are more suited to the level of delegation you are comfortable with.

As a trustee of the pension scheme, you retain ultimate accountability for the scheme investments. Therefore, it is vital that you fully understand the roles and responsibilities being delegated and maintain appropriate oversight of the decision-making and activities of the FMP.

There are certain decisions you must retain ownership of, although a FMP may provide advice on these matters. For example, in relation to a DB scheme these decisions should include the following:

- The strategic asset allocation to adopt for the scheme as the scheme develops.

- The level of expected return and risk to be targeted at different time horizons (these may be set relative to the liabilities).

- The degree of flexibility in the mandate, for example in relation to the level and range of investment in (and between) asset classes and the risk tolerances.

- Strategic decisions on liability management, such as buy-ins of tranches of benefits and longevity hedging.

- Decisions in relation to the extent to which environmental, social and governance (ESG) considerations — including climate change — and wider sustainability issues should be reflected in the investment strategy and investment implementation of the scheme.

- The decision to replace the scheme’s FMP, for example due to

- poor fiduciary mandate performance being delivered

- the trustees deciding to adopt a different governance model for the scheme, for example once the scheme funding level had improved and/or the trustees’ objective changed to targeting a buy-out of the scheme

- the fiduciary mandate offering poor value for money and/or high costs relative to other market opportunities

Deciding who to invite to tender

Before inviting providers to tender, you should seek to understand the range of fiduciary management services and providers available. If you choose to run the exercise yourself, you may find it helpful to send an expression of interest inquiry to a selection of providers. Include some high-level information on your scheme and requirements and some preliminary questions to gather the information that will help you develop your longlist of providers to invite to tender.

If you are using an independent third party evaluator, they will research the market and advise you on which providers might be appropriate to include on your longlist.

Invitations to tender

An invitation to tender should focus on asking providers to recommend a bespoke investment and risk management solution based on your scheme’s needs and objectives. Your invitation to tender should include some background information on your scheme and your requirements. This might include, for example, details of the following:

- Your scheme: The current asset allocation, the nature and duration of the scheme’s liabilities, the scheme size and the level of scheme cashflows.

- Your objectives: This will enable the providers to demonstrate how the portfolio they propose will support you in meeting your objectives.

- Your agreed governance structure: This will enable providers to understand the level of delegation and decision-making you are seeking.

- Key investment beliefs: This will enable providers to demonstrate how their proposal for the mandate aligns with your key investment beliefs.

- Exclusions: It is also useful for providers to understand if there are any particular ‘red lines’ in terms of asset classes or manager selection, for example, if you do not wish the FMP to use their in-house pooled funds for investing in alternative or illiquid investments. This might be due, for example, to concerns over conflicts of interests, a requirement for ‘best of breed’ opportunities to be considered at all times or the potential difficulties in transferring the funds at a later date.

The invitation to tender should also include a number of key questions which, when combined with their answers to your requirements above, will enable you to determine which provider might be most suitable and best meet your requirements. For example, these questions could include a request to provide details of the following:

- Their firm, their areas of expertise and relevant experience of similar arrangements.

- Their ability to successfully identify and select investment opportunities, together with supporting evidence.

- Their views on the current investment arrangements and the proposed fiduciary management mandate and how that might be modified or developed to enable an improved outcome to be delivered.

- Their proposed fee structure (including any performance fee structures) and the level of fees and expenses that they would expect to apply to the fund. It is important that this information is reported consistently to enable you to compare bids. See the section on fees and costs.

- The potential costs of transitioning into the proposed arrangement and the costs that might be incurred on future exit, if that was deemed necessary.

For further matters to consider in an invitation to tender, see Appendix C.

Reviewing fiduciary manager submissions

You should design a process that will enable you to assess each submission consistently to identify the potential fiduciary management providers that can meet your requirements. You may wish to consider designing a scorecard and applying weights to each criterion based on the level of importance of those issues in meeting your requirements.

An example of a scorecard that could be used when assessing fiduciary managers is outlined in Table 1 below. The details and weightings applied below are for illustration only and should not be taken as being representative of what might be appropriate in any particular case. In Appendix C, we have given some examples of the types of topics trustees could consider when designing an invitation to tender and deciding your criteria for scoring and selecting a provider for your scheme.

Trustees should consider their objectives in appointing a fiduciary manager for their scheme and develop an appropriate scoring system based on their requirements and with weightings applied that are appropriate for their scheme.

Each of the individual submissions are graded between 1 and 5 (1 = poor, 5 = excellent) and then weights are applied to each item to establish an overall score.

The examples below provide some topics you may wish to consider when deciding your criteria for selecting a provider and designing an invitation to tender.

Table 1: Example of a scorecard that can be used when assessing fiduciary managers

| Requirements based on: | Weighting | Score (1-5) |

|---|---|---|

| Firm, scale resources | 10% | |

| Responsible individuals | 10% | |

| Proposed interaction | 10% | |

| Manager selection/asset allocation | 40% | |

| Monitoring reports | 10% | |

| Investment/strategic views | 10% | |

| Fees, implementation, references | 10% | |

| Total | 100% |

Please note: This example is for illustrative purposes only. Weightings and requirements should be based on your objectives for the scheme’s and your trustee board requirements.

Fees and costs

It is important that you can compare the estimated costs and charges of each FMP in a consistent way to make a fair assessment of the value for money in appointing that provider.

Fiduciary management providers (FMPs) who are subject to the CMA order must report the total annual costs and charges relating to the service they are proposing, and this should be expressed as both a percentage of assets under management and as a cash amount. This should also be supported by an itemisation of all costs and charges likely to be incurred over a 12-month period, such as the cost of advice and implementation, asset management fees, transaction costs, and any one-off costs likely to be incurred.

You should also expect providers to outline the expected cost of transitioning into and out of the fiduciary management service. It should also make clear which costs would be deducted directly from assets and those which would be invoiced separately. To enable you to compare bids, you should consider adding a table to your invitation to tender so that providers report the information in a consistent way and can include all the services you require. You should also allow for the impact of any tax charges that might apply in addition.

It is particularly important to understand any costs that might be incurred if a decision is made in the future to exit from the fiduciary management agreement. Depending on the proposed underlying investments and the holding structure for those investments, significant costs and exit charges could be incurred, particularly in relation to illiquid and alternative investment funds. This transition process can also be lengthy, particularly in relation to certain types of investments and fund structures, and it could take some time to fully transition the whole portfolio to another provider. It is therefore important that you are aware and understand the potential costs and restrictions that might apply if you decided to exit the agreement, before you select a preferred provider and enter into the fiduciary management agreement.

You should understand which services are included in the itemised statement and which services are not. If there are additional services you expect to regularly recur, and you expect them to be reasonably predictable, you should also seek to get those itemised. You should also ask the provider for an estimate of the extent of incidental services, such as advice on refining the investment portfolio or legal fees that are likely to be required each year. This will enable you to obtain a fair view of the likely total annual cost and will also help you make a fair comparison between potential providers.

Example breakdown of indicative fees

- Illustration of indicative total fees to be charged for the service each year to include a breakdown of the following:

- Fee for core fiduciary management service including advice and implementation. Any performance management fees must be separated out from the fiduciary management fee.

- Asset management fees covering funds or fund-of-funds provided by the fiduciary management provider, and those provided by third party asset managers. These costs and charges must include any costs associated with execution such as transaction costs and performance-related payments.

- Other investment costs such as custodian fees, administration charges or charges for ancillary services.

- Any one-off fees likely to be charged to include the following:

- Estimated transaction costs likely to be incurred in moving assets into the proposed portfolio.

- One-off fees for advice.

- Any other one-off charges such as legal fees or costs of onboarding services.

- Potential exit fees and costs to include the following:

- Any explicit costs and charges that would be incurred as a result of a change of fiduciary management provider or ceasing to obtain fiduciary management services, such as exit charges or ‘lock in’ fees in the contract that would be incurred if you ended the agreement or changed fiduciary manager.

- A statement that transaction costs might be incurred in switching provider or ceasing to obtain fiduciary management and that such costs may be similar in magnitude to those disclosed. This statement must also include any features of the proposed portfolio which might increase such transaction costs.

To support you in receiving fee information in a consistent way, the Cost Transparency Initiative (CTI) has produced a suite of voluntary templates and guidance designed to help trustees understand and compare the costs of their investment services by using a standardised reporting format.

These templates can be used to request charges information and are available on the Pensions and Lifestyle Savings Association (PLSA) website.

Performance

The CMA found that FMPs presented their historical performance information using different approaches. This has meant it has not been easy for trustees to assess and compare the track records of FMPs.

The CMA order required the industry to put in place a standardised methodology and template for providing information on past performance to potential pension scheme trustee clients. The Chartered Financial Analyst (CFA) Institute acquired the intellectual property rights to a fiduciary management performance standard, which the CMA approved in the December 2019 GIPS Standards for FMPs to UK Pension Schemes (cfainstitute.org) Providers of fiduciary management services must use the standard in tender submissions and marketing communications to provide information on their historic performance.

Further guidance on how you might assess the performance of potential providers of fiduciary management services and the performance of existing FMPs is provided in appendix D - Global Investment Performance Standard for FMPs for UK Pension Schemes.

Engage with shortlisted providers

Once you have reviewed and assessed the tender submissions, you may wish to eliminate a number of the managers who do not adequately meet your tender criteria. As you will be expecting to work with the fiduciary manager for a considerable period of time and the costs involved are significant, you may want to meet with the potential providers to understand how they might work with you and meet your requirements. You may want to invite your shortlisted providers to present to your board or a sub-committee responsible for the exercise and answer any questions you may have about their proposal for your scheme and any questions that may have arisen as part of their tender submissions.

Once the shortlisted candidates have presented to the board, you may have identified a clear preferred provider, or you may have narrowed your selection to a final two or three providers with whom you may seek to negotiate improved fee and service terms. You may also find it useful to go on site visits to their offices to better understand the structure of their organisation and meet the key individuals who would be responsible for looking after your scheme.

Documentation of process

When the tender process is complete, you should prepare a summary of your reasons for appointing the fiduciary manager(s) and the objectives and service standards that you expect the fiduciary manager to deliver against.

Oversight

As trustees, you remain responsible for the scheme, including setting the overall investment strategy and monitoring the activities and performance of your fiduciary management service provider. Once you have appointed your fiduciary manager, you should ensure that you regularly review their performance and their ongoing suitability as a fiduciary manager to be retained by the scheme.

The objectives you set for your fiduciary manager should be linked to your investment objectives for the scheme so that reporting of performance will allow you to review the value added by appointing a fiduciary manager.

You should be aware of the potential for organisations to change and factors that influenced your decision to appoint the fiduciary manager initially can change significantly over time. For example, the loss of key staff or key mandates, the demotion of fiduciary management as a line of service within a group organisation (with consequent impact on resourcing etc), a change in investment approach with less focus on a preferred style of asset management or a preferred asset class, or a change in risk controls.

Given the significance of the fiduciary management appointment to your future scheme outcomes, you may wish to consider using an independent third party to provide oversight of your fiduciary manager’s performance and their ongoing suitability to meet the requirements of your scheme. That third party will also be able to help you decide whether any changes in the fiduciary manager or their mandate remit are necessary.

Appendix A: Examples of third party evaluators

| Pros | |

|---|---|

| Investment consultants |

Most investment consultancy firms that offer services to occupational pension schemes will offer a third-party selection service to support you in running a tender. They will also offer advice on investment governance structures. They will have knowledge of the fiduciary management market, though the level of knowledge will vary between firms. Some investment consultants will have teams that specialise in the selection and oversight of FMPs. These firms will have specialist knowledge and will have researched the market to support the shortlisting of providers for tender. |

| Professional trustees | Some professional trustees may provide guidance on governance structures. They may also support the board in running an effective tender process. They may bring experience and knowledge of using fiduciary management on other schemes. |

| Dedicated selection and evaluation firms |

There are a number of independent third-party selection firms that can support you in putting a tender process together. Some firms also specialise in governance and can provide advice on governance models. There are also some firms that specialise in the selection and oversight of FMPs. These firms have specialist knowledge and will have researched the market to support the shortlisting of providers for tender. |

| Cons | |

| Investment consultants |

If your investment consultant only offers advisory services, there may be an inherent bias in their advice on governance towards the advisory model. If your investment consultant also offers their own fiduciary management service, there is a risk of bias towards their own fiduciary management firm or the style of their own fiduciary management service offering either when providing information on governance models or supporting a tender exercise. |

| Professional trustees |

They are less likely to have detailed knowledge of the whole of the market and market developments. They may not have sufficient resources and expertise to conduct regular research and due diligence on providers in the market. Recommendations based largely on previous experience of working with providers are not sufficient either for shortlisting or appointing providers. Decisions that should be made by the trustee board may be unduly driven by the views of the professional trustee or their firm. |

| Dedicated selection and evaluation firms |

There are significant differences between third party selection firms, their scale, structure and experience. These can vary from sole traders to dedicated governance teams within large multi- disciplinary practices. It is important to understand the extent of the service they can offer you. Some may be able to help run a competitive tender process, but they may not have specialist knowledge of the market to advise you appropriately and you may not achieve the best outcome for your members. In the case of a firm that specialises in fiduciary oversight, there may be an inherent bias in their advice on governance towards the fiduciary model. |

Appendix B: Scheme example, applying the principles of tendering for fiduciary management

Scheme background

This is a DB scheme with an employer that has limited affordability to pay contributions for a period of years due to the business operating in a declining sector. Despite contributions being paid, the funding level has not improved since the last formal actuarial valuation. The trustees have some investment experience but rely heavily on one trustee when making decisions based on the advice of their investment consultant. The trustees periodically considered hedging the scheme’s liabilities but had never felt comfortable in implementing a significant level of hedging.

The employer asked the trustees to consider exploring whether fiduciary management could improve the scheme funding level over time and agreed to pay reasonable costs incurred from appointing a third party evaluator to assist them with a review of their investment governance.

Reviewing investment governance capability

The third party evaluator worked with the trustees to review their existing scheme governance, which included roles and responsibilities, how the trustee board functioned and how board membership might evolve in the future. With the help of the existing investment consultant, the third party evaluator also arranged a workshop to help the trustees:

- establish their investment beliefs

- define their objectives for the scheme over different horizons (with participation from the employer)

- understand different investment governance models

- understand how their existing investment advisory governance model may be improved

- understand how either a full or partial fiduciary solution could be implemented to benefit the scheme

Following the review, the trustees and employer agreed to move the scheme’s assets into a fiduciary management mandate.

Preparing the specification

Based on the work the third party evaluator did with the trustees to review their governance capability, they put together a high-level specification for the fiduciary mandate selection which captured the trustees’ beliefs, objectives and risk tolerances for the mandate and the trustees’ general requirements for the appointment. These included the following:

- The investment strategy put in place should target an investment return of liabilities + 2.5% per annum, tapering to liabilities + 1.5% after 10 years and to liabilities + 0.5% after 20 years, with a funding level volatility of 8% to 10%, initially tapering to 6% to 8% after 10 years and 4%-6% after 20 years.

- Over the medium to longer-term, as the funding level was expected to recover, the fiduciary manager should be able to explore opportunities to effect a liability risk transfer for segments of the membership by way of an insurance company buy-in.

- Active management and investment in illiquid and alternative investments could add value, if the manager selection (and rotation) was done by individuals with the expertise, skills and resources necessary to be able to effect decisions on a timely basis.

- Unrewarded risks should be hedged, diversified or transferred.

- Assets should be invested in funds in the name of the trustees, which could be assigned to the new fiduciary manager (rather than sold for ‘cash’) if the trustees ever decided to terminate the fiduciary management contract.

Deciding who to invite to tender

The third party evaluator mapped the trustees’ high-level requirements against the full range of fiduciary management opportunities in the market, allowing for the scheme scale and characteristics, and their market knowledge of the firms (eg their size of firm, any loss of staff, loss of mandates, underperformance etc).

The third party evaluator produced a brief report for the trustees on a longlist of nine potential fiduciary managers, with a brief outline of the firms and their fiduciary management products. This list included the trustees’ existing investment consultant who had their own fiduciary management arm as they met the trustees’ high-level requirements. They also explained which fiduciary managers they discounted and why.

The third party evaluator and trustees discussed the differences, similarities, strengths and weaknesses of the nine fiduciary managers on the longlist and agreed to invite six of the fiduciary managers to formally tender.

The tender process

The third party evaluator was able to rely on their existing research and ratings of fiduciary managers to provide some of the inputs into the trustee briefing papers. To supplement this, they prepared an invitation to tender, which included:

- the scheme background and the trustees’ reason for tendering

- the trustees’ high-level requirements for the tender

- the expected timeline for the tender and implementation

- the contact details for the chair of the trustees (to enable an introductory conversation)

- the third party evaluator contact details for specific queries relating to the tender submission

They included a series of questions which would require firms to provide details on matters such as:

- their firm, areas of expertise and relevant experience of similar DB arrangements

- the individuals who would be directly responsible for their scheme

- how they proposed to interact with the trustee, frequency of meetings, levels of trustee training

- their ability to successfully identify and select investment opportunities, together with supporting evidence as required by the fiduciary management performance standards

- the investment and risk monitoring reports they would produce for the trustees

- their views on the current investment arrangements and the proposed fiduciary management mandate, and how that might be modified or developed to enable an improved outcome to be delivered

- the timeline they proposed to implement the fiduciary management strategy if appointed

- the potential transition costs that would be involved in on-boarding and how those costs would be managed

- their proposed fee structure (including any performance fee structures) and level of fees and expenses that they would expect to apply to the fund

- trustees they have worked with and would be prepared to provide references

The six fiduciary managers were given four weeks to respond to the invitation to tender and five responses were received. The other fiduciary manager declined to tender following an introductory call with the trustee chair, recognising that given the timescales involved and their current business commitments, they would have been unable to meet the trustees’ timeline and expectations

Reviewing bids and making a decision

With the help of the third party evaluator, the trustees assessed and graded the individual submissions between 1 and 5 (1 = poor, 5 = excellent) against a weighted scorecard agreed with the trustees. This was broadly based on the example in Table 2 below:

Table 2: Example of a scorecard that can be used when assessing tender submissions

| Requirements based on: | Weighting | Score (1 to 5) |

|---|---|---|

| Firm, scale resources | 10% | |

| Responsible individuals | 10% | |

| Proposed interaction | 10% | |

| Manager selection/asset allocation | 40% | |

| Monitoring reports | 10% | |

| Investment/strategic views | 10% | |

| Fees, implementation, references | 10% | |

| Total | 100% |

Please note: This example is for illustrative purposes only. Weightings and requirements should be based on your objectives for the scheme’s and your trustee board requirements.

Following assessment of the written submissions, there was a clear leader and one firm which did not meet the requirements. The difference between the third and fourth ranked managers was marginal. The trustees wanted to invite three managers to present to them and decided that the fourth placed manager should be offered the opportunity to present as they offered a different proposition to the third placed manager (who offered a very similar proposition to the first two managers).

The third party evaluator invited the three managers shortlisted to present to the trustees, and the trustees were also given time to ask questions. Following the presentations, the trustees identified their preferred provider but felt that given their scheme’s scale, they might not get the level of support and service that a larger scheme might get. They also wanted to validate the bid in relation to operational due diligence and investment manager selection.

The trustees decided to do site visits to both their preferred provider and the provider ranked second. Following the site visits, the trustees concluded that, while their preferred provider would deliver the service required, the second ranked provider offered the best overall service proposition for their scheme.

The selected firm was asked to review their fees and terms and conditions, and the third party evaluator and the trustees’ legal advisers provided views on the fees and contractual terms offered. Following advice, the trustees negotiated a further reduction in annual fees.

The third party evaluator prepared a brief document setting out the process the trustees had gone through, which included the key decisions and the main reasons why those decisions were made.

The trustees subsequently agreed to appoint the third party evaluator to provide independent oversight on the performance of the fiduciary manager appointment on an ongoing basis.

Role of existing investment consultant

The trustees were mindful of conflicts that could arise due to their existing investment consultant being part of a firm whose fiduciary management arm was involved in the tender process. Their existing adviser agreed to stay at arm’s length in relation to designing and running the tender exercise but was engaged where possible to provide input on the scheme’s current circumstances. The existing investment adviser and the trustees agreed that this was essential to manage conflicts of interest. It also provided comfort to some fiduciary managers who were considering tendering but were concerned about the potential for commercial conflicts to arise due to the existing investment consultant’s connection with a competitor firm.

Appendix C: Example topics to consider as part of a fiduciary management tender exercise

The examples below provide some topics you may wish to consider when deciding your criteria for selecting a provider and designing an invitation to tender.

| Corporate profile: To understand the organisational structure and their long-term commitment to fiduciary management |

|---|

|

| Operational effectiveness: To understand how effective the business is likely to be at delivering the expected service |

|

| Governance: To understand how key decisions are made and key risks are controlled |

|

| Investment approach: To understand how the fiduciary manager’s attitude to investment, risk management and investment implementation for pension schemes influences future outcomes |

|

| Investment manager resources and selection: To understand how investment managers are selected, the structure of the portfolio and its suitability |

|

| Environmental, social and governance (ESG), and sustainability considerations, including climate change and stewardship: To understand how these issues are integrated into the firm’s investment approach |

|

| Reporting: To understand how performance will be reported and the quality of those reports |

|

| Fees and costs: To understand how fees and costs are reported, disclosed and managed |

| See the section on fees and costs. |

Appendix D: Global Investment Performance Standard for FMPs for UK Pension Schemes

This appendix provides some guidance on how trustees can assess the performance of potential (and existing) providers of fiduciary management services using a performance standard approved by the CMA.

What are Global Investment Performance Standards?

The Global Investment Performance Standards (GIPS) were created by CFA Institute to provide an ethical framework for the calculation and presentation of the investment performance history of an investment management firm. The GIPS standards are a voluntary set of standards based on the fundamental principles of full disclosure and fair representation of performance results.

The objectives of the GIPS standards are to:

- promote investor interests and instil investor confidence

- ensure accurate and consistent data

- obtain worldwide acceptance of a single standard for calculating and presenting performance

- promote fair competition among investment firms

- promote industry self-regulation on a global basis

GIPS for fiduciary management providers to UK pension schemes (‘GIPS standards for FMPs’)

The CFA developed the GIPS standards for fiduciary management providers (FMPs) to address part 6 of the CMA order by requiring FMPs to present historical performance using standardised methodologies and templates to potential pension scheme trustee clients. They will provide clients with greater transparency and help them better compare the historical investment performance of FMPs. The CMA approved these standards for use by fiduciary managers in the UK in accordance with Article 10 of the CMA order in December 2019.

The purpose of the GIPS standards for FMPs is to:

- promote ethics and integrity

- promote pension scheme trustee’s interests and instil confidence in pension scheme trustees

- ensure accurate and consistent data

- obtain acceptance of a single standard for calculating and presenting performance

- promote fair competition among fiduciary management providers (FMP)s

The GIPS standards for FMPs to UK pension schemes are set out on the CFA’s website in GIPS Standards for Fiduciary Management Providers - GIPS (the GIPS standards for FMPs). More detailed explanation of each provision contained in the GIPS standards for FMPs is set out in The GIPS Standards Handbook for Fiduciary Management Providers. An example of a GIPS composite report is included in Appendix B, on pages 33 to 35 of the GIPS standards for FMPs. A glossary is also included on pages 25 to 30.

All FMPs must comply with the GIPS standards when providing information to potential pension scheme trustee clients, including in all tender submissions and marketing communications. Before claiming compliance, FMPs must take all necessary steps to ensure that they have satisfied all the applicable requirements of the GIPS standards for FMPs.

The GIPS standards for FMPs do not address every aspect of performance measurement. The standards and guidance will evolve in response to market needs and issues raised by market participants. Any developments will be made available on the CFA webpage to make sure that all those that are working with the FMP standards have access to an identical set of information. Refer to that webpage to ensure that you have access to the latest publications.

The CFA have a published list of firms that have claimed compliance with the standards and agreed to have their names published on their website - Organisations Claiming Compliance with the GIPS Standards.

Overview of GIPS standards for FMPs

The GIPS standards for FMPs are divided into four sections:

- Fundamentals of compliance: This covers the core principles underlying the GIPS standards for FMPs, including the requirements to provide GIPS composite reports to all prospective pension scheme trustee clients, to adhere to applicable laws and regulations and to ensure that information presented is not false or misleading.

- Input data and calculation methodology: This mandates the use of consistent input data and the use of certain calculation methodologies to facilitate comparable presentations.

- Composite maintenance: This sets out how schemes managed according to a similar investment mandate, objective, or strategy should be aggregated to form a meaningful composite. Appendix A sets out the composites that need to be considered. To prevent FMPs from cherry-picking their best performance, they are required to:

- create and maintain composites for all strategies for which they manage UK pension scheme assets

- include all actual, fee-paying, discretionary UK pension schemes in at least one composite

- maintain and make available information about all of the strategies they manage using composites

- GIPS composite report: This details the requirements and recommendations for reporting. Appendix B presents a sample GIPS composite report.

Each individual section is divided into (minimum) requirements and recommendations. Some further details are provided below. The standard sets out that “meeting the objectives of fair representation and full disclosure is likely to require more than simply adhering to the minimum requirements…” and that “Fiduciary Management Providers should also adhere to the recommendations to achieve best practice".

Fundamentals of compliance

Requirements

The standard sets out 27 primary and 18 subsidiary requirements and includes requirements in relation to:

- compliance being met on a fiduciary management provider-wide basis (and not at a composite or scheme basis)

- demonstration of compliance for a minimum of five years or for the period since the fiduciary management provider incepted (if less than five years)

- provision of an updated GIPS composite report at least once every 12 months

- exclusion of theoretical performance from any GIPS composite report

- prohibition of any alterations of historical performance based on changes in the fiduciary management provider’s organisation

- how, and under what circumstances, performance from a past fiduciary management provider may be used to represent the historical performance of the new or acquiring fiduciary management provider and linked to the performance of the new or acquiring fiduciary management provider

- how and when a fiduciary management provider must notify the CFA Institute of its claim of compliance, including how and when that claim of compliance must be updated

Recommendations

The standard sets out three recommendations in relation to the fiduciary management provider. They should:

- comply with the recommendations of the GIPS standards for FMPs, including recommendations in any interpretive guidance published

- update GIPS composite reports quarterly

- provide to each current client a GIPS composite report of the composite in which the client’s scheme is included

Input data and calculation methodology

Requirements

The standard sets out 32 primary and 19 subsidiary requirements and include requirements in relation to:

- provider assets and composite assets, including in relation to the use of fair values and that the performance being disclosed is based on the actual assets managed

- general/accounting, including in relation to the treatment of income, fees and returns on cash

- valuation, including in relation to the use of fair values, calendar year period for composites and the treatment of historical pricing

- scheme returns (time-weighted), net returns, relative returns (composite and scheme)

- benchmarks, including in relation to the use of client-specific liability benchmarks and hedge-ratio adjusted benchmarks

- risk measures, including in relation to the use of monthly composite relative returns when calculating ex-post standard deviation, maximum drawdown and the information ratio

Recommendations

The standard sets out six primary recommendations in relation to:

- valuation of schemes on the date of all external cash flows

- valuations being obtained from a qualified independent third party

- accrual accounting being used for dividends

- investment management fees being accrued

- returns being calculated net of non-reclaimable withholding taxes on dividends, interest, and capital gains, with reclaimable withholding taxes being accrued

- the hierarchy to be included in policies and procedures for determining fair value for scheme investments on a composite-specific basis

Composite Maintenance

Requirements

The standard sets out eight primary requirements and includes requirements in relation to the following:

- All actual discretionary schemes included in total fiduciary management provider assets being included in at least one composite.

- Composites including all schemes that meet the composite definition.

- Any changes to a composite definition not being applied retroactively.

- New schemes being included on a timely and consistent composite-specific basis.

- Only schemes that are managed for the full performance measurement period being included in the composite.

- Terminated schemes being included in the historical performance of the composite.

- Schemes not being moved from one composite to another unless documented client-directed changes make it appropriate, with the historical performance of the scheme remaining with the original composite. Schemes not being moved as a result of fiduciary management provider’s tactical changes.

- The fiduciary management provider must create composites consistent with the following required composite structure.

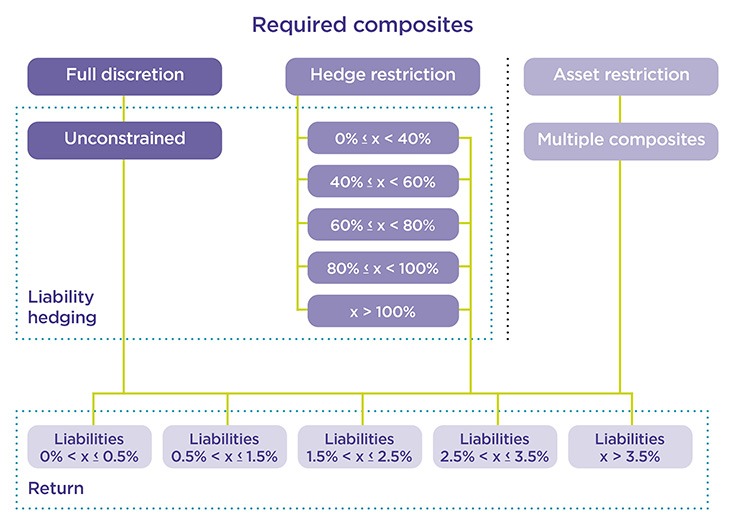

Figure 1: Required composite structure

Scheme-specific investment restrictions

Some schemes under fiduciary management may have investment restrictions in their mandates that means those schemes are managed in a different way to other schemes in the composite strategy. To avoid the FMP’s performance track record for that composite strategy being distorted, schemes with discretionary mandates and specific investment restrictions may be separately presented in a ’restricted‘ version of the required composite.

A simplified version of the chart above is in the table below for the non-asset restricted composite strategies. You can produce a similar simplified table to capture any asset restricted (which may be unconstrained or hedge restricted) composite strategies.

| Non-asset restricted | |||||

|---|---|---|---|---|---|

| Hedge restriction | Return target | ||||

| Liabilities + 0.0% < x < 0.5% | Liabilities + 0.5% < x < 1.5% | Liabilities + 1.5% < x < 2.5% | Liabilities + 2.5% < x < 3.5% | Liabilities + > 3.5% | |

| Unconstrained | |||||

| 0% < x < 40% | |||||

| 40% < x < 60% | |||||

| 60% < x < 80% | |||||

| 80% < x < 100% | |||||

| > 100% | |||||

Additional composites

Fiduciary Management Providers are required to include discretionary schemes in at least one of the required composites but may create additional composites beyond those required.

Recommendations

The standard sets out one recommendation.

- Actual schemes may be included in composites other than those that are consistent with the required composite structure (eg. sub-composites or umbrella composites), but fiduciary management providers are not required to create such composites.

GIPS composite report: presentation and reporting

Requirements

The standard sets out four primary and 16 subsidiary requirements. This includes the requirement to present the following in each GPS composite report:

- At least five years of performance (or for the period since the composite inception date if the composite has been in existence less than five years), increasing by an additional year of performance each year, up to a minimum of 10 years of performance that it complies with the GIPS standards for FMPs.

- For unconstrained mandates, any scheme relative returns or composite relative returns relative to the liability benchmark.

- For hedge-constrained mandates, scheme-relative returns or composite relative returns relative to both the liability benchmark and the hedge ratio–adjusted benchmark, with equal prominence.

- The number of schemes in the composite as of each calendar year-end (unless there are three or fewer schemes at calendar year-end).

- Where more than or fewer schemes for the full year, information about internal dispersion of annual individual scheme relative returns for each calendar year.

- Where the composite includes four to nine schemes for the full calendar year, present the median, high, and low annual individual scheme relative returns.

- Where the composite includes 10 or more schemes for the full calendar year, present the median, high, low, 90th percentile, and 10th percentile annual individual scheme relative returns.

- The three-year annualised ex-post standard deviation (using monthly composite relative returns) as of each calendar year-end.

- The annualised ex-post standard deviation (using monthly composite relative returns) for the 3-, 5-, 7-, and 10-year periods and for the period from inception.

- The annualised composite relative returns for the 1-, 3-, 5-, 7- and 10-year periods and for the period from inception.

- The three-year annualised information ratio (using monthly composite relative returns) as of each calendar year-end.

- The annualised information ratio (using monthly composite relative returns) for the 3-, 5-, 7- and 10-year periods and for the period from inception.

- The maximum drawdown for the 1-, 3-, 5-, 7- and 10-year periods and for the period from inception.

The standard also includes the requirement concerning:

- the percentage of the total fair value of composite assets valued using subjective unobservable inputs as of the most recent calendar year end, if such investments represent a material amount of composite assets

- clearly label or identify the periods and the returns and risk measures

- clearly identify any breaks in track record, for example, where a composite loses all of its member schemes but later gains new member schemes and to not link performance prior to the break in track record with performance after the break

Recommendations

The standard sets out two recommendations that the fiduciary management provider should:

- present more than 10 years of annual performance in the GIPS composite report

- present the percentage of assets in the composite that were valued using preliminary, estimated values as of each calendar year end

GIPS composite report: disclosure requirements

Requirements

The standard sets out 31 primary requirements, including requirements for the fiduciary management provider to make disclosures in relation to:

- the composite description, the benchmark, the reporting currency, the composite inception and creation dates

- how leverage, derivatives and short positions have been used historically if material

- information that is available on request, including information about:

- fees and other costs

- the composite risks

- the composite descriptions

- the policies for valuing investments

- calculating performance

- preparing GIPS composite reports

- withholding taxes, if material and whether scheme returns used to calculate composite relative returns are gross or net of withholding taxes

- all significant events that would help interpret the GIPS composite report for a minimum of one year and for as long as it is relevant to interpreting the track record

- where and how the GIPS composite report conforms with laws and regulations that conflict with the requirements of the GIPS standards for FMPs

- the use of a sub-advisor and the periods a sub-advisor was used

- any returns or risk measures that are included in the gips composite report beyond those that are required to be included

- any changes to the composite description or name for as long as it is relevant to interpreting the track record

- the composite’s valuation hierarchy if it materially differs from the recommended valuation hierarchy

- material changes to valuation policies, calculation policies or methodologies

- performance from a past fiduciary management provider, if presented, and for which periods

- the use of preliminary, estimated values, if used to determine fair value

- any change to the GIPS composite report resulting from the correction of a material error for a minimum of one year and for as long as it is relevant to interpreting the track record

- where a liability proxy benchmark or a gilt of similar duration to the liabilities is used as the benchmark, the following: “Some or all of the schemes have a performance track record using a liability proxy benchmark/gilt of similar duration to the liabilities. The level of volatility risk reported will typically be lower where a liability proxy benchmark/gilt of similar duration to the liabilities has been used.”

Recommendations

The standard sets out three recommendations that the fiduciary management provider should disclose:

- material differences between the benchmark and the composite’s investment mandate, objective, or strategy

- the key assumptions used to value investments

- how research costs are reflected in returns

Appendix E: sample GIPS composite report

An example of a GIPS Composite Report is included in Appendix B, on pages 33 to 35 of the GIPS standards for FMPs. A glossary is also included on pages 25 to 30.

Limitations of GIPS standards for FMPs