As the trustee of a scheme providing defined contribution (DC) benefits you should make sure the board has the right governance, skills and knowledge to work effectively together, and with pension scheme advisers, so that good decisions are made and members’ interests are protected.

Published: July 2016

Last updated: March 2024

28 March 2024

Minor changes made throughout to align the guidance with the new code of practice.

28 July 2016

First published.

Introduction

Running a pension scheme effectively requires particular knowledge, understanding and skills both within the trustee board and through external experts.

You should have a clear understanding of your role and responsibilities, including the scope of your powers under the scheme rules and documents, and the basis on which you can act – eg how decisions can be voted on. You also need to understand how your scheme is structured and managed and be familiar with its business plan, including strategic objectives.

As part of your own risk assessment it is important to review your scheme’s governance framework, including policies and processes, to ensure it remains effective and continues to reflect good practice.

The skills that different individuals bring to the board can significantly complement technical knowledge.

Relevant skills are wide ranging but include:

- ability to absorb and analyse large quantities of information

- communicating

- attention to detail

- business experience, including challenging advice and negotiating

- thinking analytically, creatively and strategically

- problem solving

- collaborating with and motivating others

- ability to deliver

You should consider how to support the development or improvement of skills as well as knowledge and understanding when developing your training plans. This could involve a formal training course or it might simply mean researching some learning activities to carry out as part of a formal or informal board meeting.

The type and extent of knowledge, understanding and skills needed, and the time required to fulfil your duties, will vary from scheme to scheme. In general, the time spent should be proportionate to the risks to the scheme and how well-managed those risks are.

It is unlikely that you can govern your scheme effectively through formal board meetings alone. Many boards require support from outside the scheme to ensure that processes and practices, including services to the scheme, are managed effectively. You could consider asking whether the employer is able to provide relevant resources, such as secretariat or HR staff, to assist with this aspect of scheme management.

Obtaining and improving knowledge and skills

At least annually, you should assess your own knowledge, understanding and skills – including self evaluation of the decisions you have made. Chairs should consider whether to support this process by carrying out performance appraisals with individual trustees.

You should also carry out an annual evaluation of the performance and effectiveness of the board as a whole, including the chair, with reference to the objectives set out in your scheme’s business plan. This is particularly important as most trustee boards need to report annually in their chair’s statement how they collectively possess or have access to the knowledge and understanding necessary to properly run the scheme.

There are a number of ways that you could go about this, eg through a peer review process, through the scheme secretary, by issuing an open or secure questionnaire or, in the case of larger schemes, it might be appropriate to employ an external agency to carry out a review. Subject to confidentiality obligations, professional trustees can also help to evaluate the board by sharing their experience of how other boards operate.

See sample board evaluation questions (PDF, 63kb, 7 pages).

To help improve access to regular training, you could consider allocating some time during board meetings. This might include sessions led by an external speaker or a professional trustee, and should seek to address particular gaps in knowledge, understanding and skills. To help identify gaps, some boards might find it helpful to develop and maintain a skills matrix showing board members’ areas of specialism and interest. This could also help boards with succession planning.

See a sample skills matrix (PDF, 448kb, 9 pages).

In addition, training sessions might usefully reflect the scheme’s business plan. This would help you to meet your strategic objectives and prepare for forthcoming events that will affect your scheme, such as changes in legislation, including the decisions you will have to make. Sessions could also include a review of decisions made previously.

Training plans and methods

You will find it helpful to keep a record of training you have undertaken, as well as plans for future training. This will help to ensure that you possess, or are in the process of obtaining, appropriate knowledge and skills.

Good practice

Different types of scheme will have different training needs. However, it is good practice for your training plans to cover key areas such as:

- scheme rules and other documents relating to the running of the scheme

- pension law and regulations, our codes of practice and guidance

- investment – including setting objectives and strategies

- administration – including understanding roles and responsibilities

- decumulation – processes leading up to retirement, flexible access to benefits, the Pension Wise guidance service, open market options, and communicating the relevant information to members. For further information, refer to the communicating and reporting guide

- particular events or circumstances – such as changes to legislation, bulk transfers and how closure or full or partial wind-ups might affect the scheme

- developing and using key skills, including those listed above

When producing training plans, you should consider what learning methods are likely to work best for different individuals. You should also look at the particular needs of your scheme. In addition to board room sessions, you could consider formal qualifications, the Trustee Toolkit, seminars, role play sessions, webinars, online forums, conferences, networking events and reference material such as trade magazines and social media.

Many organisations offer training, including the Pensions Management Institute and the Pensions and Lifetime Savings Association (please note that these are examples only and we do not endorse any services). There are also frequent seminars run by advisers and service providers. Bringing a professional trustee on to the board can be another effective way of providing consistent training. Professional trustees should be able to demonstrate that they undertake continuing professional development (CPD) to improve their own knowledge and understanding.

Chairs should encourage all trustees to engage with their own learning and development needs and to make time for training. Where possible, chairs or secretaries should also work with employers to arrange time off work for appropriate training.

Working well with advisers, providers and employers

Appointing advisers and service providers

Trustee boards benefit from considering a broad range of views and opinions, including from those they rely on to provide advice and services. Therefore, choosing the right third parties to advise on and manage certain aspects of the scheme, including administration and investment, is a very important part of overall governance.

However, it’s important to retain sufficient oversight of the tasks you delegate to others but remain accountable for. This includes in-house personnel, such as HR professionals, as well as external advisers and service providers.

You should review the quality and suitability of advisers and service providers before you appoint them. This includes setting clear selection criteria, researching the reputation of different providers and asking for recommendations from a range of reputable sources, although it might be appropriate for small schemes to rely on the recommendation of a single trusted adviser. In general, you should consider multiple providers and invite tenders.

Good practice

When developing selection criteria, it is good practice to consider issues such as:

- the different types and levels of services available on the market, including the benefits they offer to members and the related costs

- ability to provide relevant data, including quality management information

- the capacity of and technology used by advisers and service providers, including the ability to integrate with employers’ processes and systems

- ways of working, including whether they offer a named person or department as a point of contact

- relevant and up-to-date qualifications or accreditations

- processes in place to protect member data

- experience of working with similar schemes with similar risk profiles. Service providers who have this experience might be able to offer helpful insight when you consider the value for members of services offered by your scheme relative to other schemes

- any professional indemnity cover they have in place and whether it is sufficient

Reviewing contracts

It is important to be familiar with and have a clear understanding of the impact of the terms and conditions of contracts for services. In particular, this means being satisfied that the contract is consistent with your aims and objectives for the service. In general, you should seek legal advice when reviewing contracts.

There are a number of questions that you will find it useful to ask yourself when reviewing a new or existing contract. Example questions are set out in the checklist below but these will vary depending on your scheme, on the type of service you require and on the criteria you used to select the adviser or service provider.

Example checklist for reviewing contracts

- Is it clear what value this service will provide to members and at what cost?

- Are there any additional charges that you should note, including when they will apply? These might include management fees, incentive fees, fees for attending trustee board meetings and expenses.

- Are there clear, reasonable and measurable service level or performance targets and an escalation process to follow if they are not achieved? You should consider the potential to include penalty clauses or reduced fee clauses to cover situations where targets are not met.

- Are the roles, responsibilities and accountabilities of each party clearly defined, including where tasks are delegated to a third party?

- Are there potential conflicts of interest?

- Is the level of discretion to vary services reasonable?

- Is there a requirement for the adviser or service provider to provide management information?

- Is there a standard of care that the adviser or service provider must adhere to?

- Is there a named person or department given as a point of contact?

- Is the level of personnel or technical expertise that you will have access to set out clearly?

- To what extent does the contract offer data protection and security (including cyber security) in relation to scheme and member information, including where tasks are delegated to a third party?

- Is the adviser or service provider able to limit its liability unreasonably? For example, where it has acted on professional advice or on instructions it believes came from you.

- Are there reasonable timescales and processes in place for releasing information back to you and any new advisers if the adviser or service provider is changed? Are any related fees reasonable?

- When does the contract end?

- What are the notice periods for breaking the contract?

- Are any fees attached to breaking the contract reasonable?

- What compensation is available to members in the event of a significant failure by an unregulated adviser or service provider?

- What provisions are in place regarding complaints or mediation should things go wrong? Is the escalation process clear?

If you are unclear about the answers to questions included in your check-list, you should ask the adviser or service provider to explain and be prepared to negotiate the terms.

Refer to the administration and investment governance guides for specific considerations relating to contracts and agreements in those areas.

Ongoing relations

It is important that you are able to understand fully and, where appropriate, scrutinise and challenge any advice you are given. This includes understanding how advice, if acted upon, will affect your scheme. Often this means probing for further information or explanation, especially where there could be a commercial incentive for the adviser or service provider (see conflicts of interest below).

You could improve your understanding of advice and the role of third parties by inviting representatives to board meetings to explain particular advice, products and services and to answer questions from the board. The discussions generated by these sessions will help you to work in partnership with third parties and will often lead to better solutions. However, it might suit some schemes to question the advice they receive more informally, such as through their ordinary day-to-day dealings.

If you use a number of different advisers and providers you might find it useful to appoint an individual trustee, pensions manager or scheme secretary to act as a central point of contact.

If your scheme uses bundled services from a single provider, you should ensure the provider supplies adequate information on the governance of each service.

Maintaining a dialogue with advisers and service providers is likely to be the most useful way for you to keep abreast of the matters affecting your scheme and to keep control over the areas you are accountable for. It should also help to avoid misunderstandings.

To help facilitate this dialogue, you should be aware of what scheme information advisers and providers need to fulfil their role and ensure it is provided in a timely manner.

You should develop and implement continuity plans to plan for how the scheme could respond to potential disruption to scheme situations a scheme may face in the future in the event of a disruption to the activities of the scheme. These plans should be regularly reviewed and recorded.Monitoring performance

To ensure that advisers and service providers continue to perform well, you should assess their performance against documented targets, measures and/or objectives on a regular basis. For many schemes this assessment will be at least quarterly. Less complex schemes with a small number of members and that carry out fewer transactions might find it appropriate to review performance less frequently unless a particular issue arises. The regularity of review may also depend on the level of involvement the adviser or service provider has in the scheme. In addition, you can use management information to identify any performance trends. Monitoring the performance of advisers and service providers is a core element of the legal requirement on many trustee boards to assess annually the value for members provided by their scheme.

If you identify areas of poor performance you should take steps to address them. Depending on the nature and extent of the failure, you should not be tempted to immediately terminate particular contracts as this could incur significant cost. In most cases you should start by requesting an improved level of service from your provider and using any complaints or mediation process detailed in the contract. After reaching a solution, you should monitor the adviser or service provider closely and ask for regular updates on their performance.

If they show no improvement, you should then consider making a change and, where appropriate, discuss this possibility with the employer. You will need to take account of issues such as risk, practical difficulties and costs to members before making a decision to end a contract. If you do consider terminating a contract you should consider seeking legal advice before doing so. You should also note that it is no longer legal for the trust deed or scheme rules to restrict the choice of advisers or service providers to the scheme.

The trustee boards of schemes using bundled services remain accountable for the provision of those services and should ensure they have access to the information and data necessary to monitor performance.

Refer to the administration and investment governance guides for specific information on how to measure the performance of advisers and service providers in those areas.

Working with employers

Having a constructive relationship with the employer can be a very positive influence on an occupational pension scheme. Therefore, where possible, you should be in regular contact with the employer and encourage them to take an active interest in running and helping to manage the scheme. This could include:

- using their technical and operational expertise, including seeking their assistance in the provision of relevant resources such as secretariat and HR

- assessing the fitness and propriety of trustee candidates

- discussing candidates for a new chair

- agreeing a process for electing MNTs seeking their views on the performance of advisers and service providers and on the effectiveness of member communications

- discussing skills and knowledge gaps on the trustee board and promoting the benefits of allowing trustees to take time off work for training

- disclosing costs and charges and encouraging employer contribution towards the cost of running the scheme

To facilitate these discussions you could consider setting up a joint trustee and employer sub-committee or dedicating part of your board meetings to this purpose.

As far as possible, you should support employers to understand and carry out their duties in relation to the scheme. This should include understanding the processes and methods they use to provide information to the scheme and talking to them about whether you, they or third party providers can make any changes that would improve these processes. For example, this might include ensuring that payroll processes allow appropriate amounts of time for automatic enrolment calculations or increasing employer awareness of contribution data standards such as the Payroll and Pension Data Interface Standard (PAPDIS).

Where you believe that employer processes or behaviours are in breach of legal requirements, you may need to notify us. See decision to report breaches of the law.

You should also provide employers with information about the services the scheme provides for them in relation to automatic enrolment. For example, whether the scheme issues automatic enrolment communications on the employer’s behalf and what costs and charges are associated with particular services.

Master trusts may find it useful to set up an employer working group or online forum to encourage feedback and discussion.

Conflicts of interest

Establishing a conflicts process

You are required by the law to have a process in place to identify and manage any conflicts of interest among those involved in running your scheme, including trustees, service providers and advisers. See conflicts of interest.

Conflicts of interest within the trustee board

These could arise, for example, in relation to employer-appointed trustees, who are also company directors, when agreeing operational costs with the employer such as those relating to administration or communications. They might also arise when the trustee board needs to review commercially sensitive information relating to the employer and the board includes a trustee who used to work for the employer or for an adviser to the employer. Alternatively, there might be a situation where the employer has proposed a change to the benefits it offers and trustees on the board are also members of the scheme.

It is important to be alert to such issues and have processes in place to manage them. For example, conflicted trustees might need to remove themselves from particular discussions or sign a confidentiality agreement, or you might need to appoint an independent trustee to oversee a particular decision process. Where possible, you should seek to ensure that the trustee board still has balanced representation in these circumstances.

Provider-appointed trustee conflicts

It is not uncommon for money-purchase pension schemes, particularly those set up by insurers, to appoint a trustee who is an employee of the provider.

Provider representation on your board can have a number of advantages, such as facilitating conversations directly with the provider. In most cases it will be possible for provider-appointed trustees to manage potential conflicts sufficiently through an established conflicts process.

However, there may be situations when the provider-appointed trustee’s role becomes untenable. They may face a conflict of interest which is particularly acute or pervasive, as a result of their employment with the provider.

One situation where this might arise could include discussions about whether it is appropriate for the trustee board to exercise certain powers in the scheme rules which may be unduly influenced by a trustee who is provider-appointed. Other examples include strategic decisions and negotiations, which could result in the termination of services offered by the provider.

Where this is the case, the provider-appointed trustee should consider whether resigning is the most appropriate course of action.

In situations like this it may be appropriate to appoint or consult with an independent professional trustee to oversee certain decisions, particularly where there is a risk of detriment to the scheme’s membership.

In master trusts, the majority of trustees on the board must be independent of advisers and service providers. If a provider-appointed trustee becomes aware of any business-related decisions which have a bearing on the scheme, they should still consider the impact this may have on their role as trustee and take steps to lessen the impact. For example, remove themselves from the decision-making process where appropriate.

Managing adviser and service provider conflicts of interest

Where permitted, it is not uncommon for advisers to recommend the service or products offered by their firm or related parties to their clients, for which there may be some form of financial or non-financial benefit (or commercial interests).

For example, an adviser could be paid for recommending other services offered by their organisation or third party. The risk to you in this situation is that the adviser does not provide, or is not seen to provide appropriate advice or services.

While there may be benefits from these types of relationships, you should be fully aware of any commercial interests that may arise from these arrangements and be prepared to challenge advice and probe for further information where necessary. You could consider whether the employer could provide relevant expertise to assist you, such as procurement personnel.

You should consider what the advantages are for members in retaining a conflicted adviser or service provider if you could instruct alternative third parties with similar expertise who are not conflicted. You should document how you make your decisions.

You should also look at the nature of the adviser or service provider interest. Where you believe that any advice or service given under these arrangements may be compromised, you should consider further measures to manage the conflict. This may include talking to other advisers or service providers, putting the service out to tender, comparing products available on the market and generally considering other alternatives.

Again, you should document the action you take. You should also outline general approaches to adviser conflicts in your conflicts policy, risk register or in other documented procedures. These should be subject to ongoing monitoring and review.

Disclosure of adviser and service provider conflicts

You should ensure you are satisfied with the effectiveness of your advisers’ and service providers’ arrangements for managing and disclosing conflicts, eg by ensuring they have a documented conflicts policy in place.

Sharing advisers with the employer

You should be aware of any circumstances in which your service provider or adviser provides services to the employer(s), eg benefit consultancy services. You should consider whether you are content for this situation to continue, or whether you should take steps to address potential conflicts.

The steps you need to take will depend on the type of adviser and advice. You should ask your advisers and service providers to inform you when they tender for services to an employer.

Risk management

Stage 1: Identifying risks

You should have a framework in place to help you identify the risks facing your scheme, which could have a material impact on its ability to provide member benefits if they are not managed effectively.

You should consider information drawn from a number of sources to help identify risks in the core areas of scheme governance and management, investment, administration and member communications. In particular you should be vigilant to key risks such as pension scams and risks relating to cyber security threats. It might also be relevant to consider longer term risks such as climate change.

Information sources

- internal audit reports

- management information

- service contracts

- complaints

- administration and investment reports

- external audit reporting

Larger, more complex schemes could consider establishing a risk sub-committee to provide a disciplined structure for risk identification, assessment and prioritisation. This would allow particular trustees to focus on identifying and managing the risks to the scheme and reporting back to the full board at regular intervals.

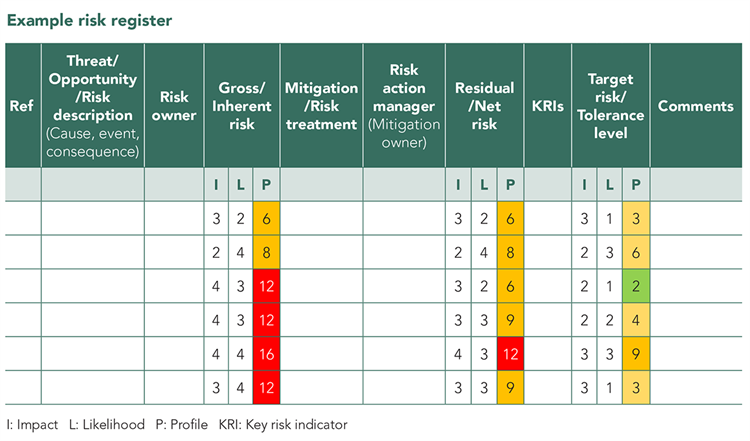

You should record identified risks in a risk register and review it regularly.

This provides a template for you to record the threats and opportunities in relation to the achievement of the objectives set out in your scheme’s business plan. It helps to clearly document the controls you implement, or propose to implement, to reduce the impact or likelihood of risks materialising and to record factors that could indicate a change in the level of risk identified (key risk indicators) – eg this could be an increase in the number of member complaints about a particular scheme service.

This template also identifies both the individual who is accountable for managing the risk (the risk owner) and the individual tasked with implementing any mitigation strategies (risk action manager), such as putting in place appropriate internal controls.

You should use an agreed evaluation process (see below under Stage 2) to rate risks at various points:

- Gross/inherent risk indicates the level of risk determined at the time of the assessment (usually before any controls have been put in place).

- Residual/net risk indicates the level of risk after controls have been implemented. If the controls are effective the ratings should be lower at this point and if this is not the case you should consider whether further controls are required

- Target risk indicates the level of risk that you are aiming to achieve before you can be satisfied that it has been successfully managed.

To ensure that you have adequate opportunity to update the risk register, you could consider whether it’s possible for your scheme to offer online access. This would allow you to update it, should information on a new or existing risk emerge in between formal review sessions.

The level of detail necessary to include in your risk register will be influenced by various factors, including the complexity of the risks facing your scheme and the number of members that could be affected should particular risks materialise.

Stage 2: Evaluating and prioritising risks

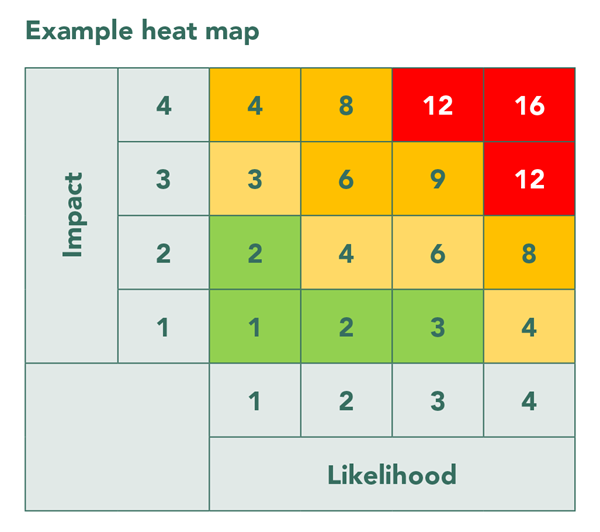

You should develop a process for evaluating risks and prioritising them according to the overall threat that they pose to the scheme. One way of rating a risk is to plot on a heat map the likelihood of the risk occurring against the impact that it will have on the scheme, should it occur.

For example, using the heat map above, you could develop a set of scheme specific criteria to determine where particular risks should sit on the map. This involves considering the level of potential impact and using your criteria to rate it as low, medium, high or critical (1-4). Then you need to consider the likelihood of the risk occurring and again use your criteria to rate it as low, medium, high or very high (1-4). Having determined a risk rating for both impact and likelihood you can multiply the figures to provide an overall risk profile figure (as shown in the heat map and risk register examples).

This will help you to visualise your scheme’s overall risk profile according to both level of impact and likelihood of occurrence. Whichever method of evaluation you choose, it should help you to direct resources to priority areas.

Stage 3: Treating risks

Simply recording and evaluating risks does not mean they are being treated. As part of your overall risk management process, you should continue to establish mitigation strategies and regularly review them to ensure they remain effective.

Clearly setting out your scheme’s risk appetite and/or risk tolerance will help further clarify your treatment of risks. For example, for risks deemed within acceptable levels of tolerance it might be appropriate to monitor the risk rather than take additional direct action, or to agree a mitigation in principle.

In addition to reviewing and updating your risk register and the effectiveness of your controls regularly, you should consider carrying out a detailed analysis of your risk management framework at least annually.

You should also continually review exposure to new and emerging risks including significant changes in, or affecting, your scheme and its membership.

For further information on risk management, including the use of risk registers and heat maps, refer to courses available through professional bodies such as the Institute of Risk Management.

You could also consider whether the employer is able to provide relevant expertise or resource to help you to manage risks effectively.