People who run pension schemes are being urged to help protect savers from scams.

The call comes as a new video is released for Scams Awareness Week 2024 (21-25 October) highlighting the devastating impact of pension fraud.

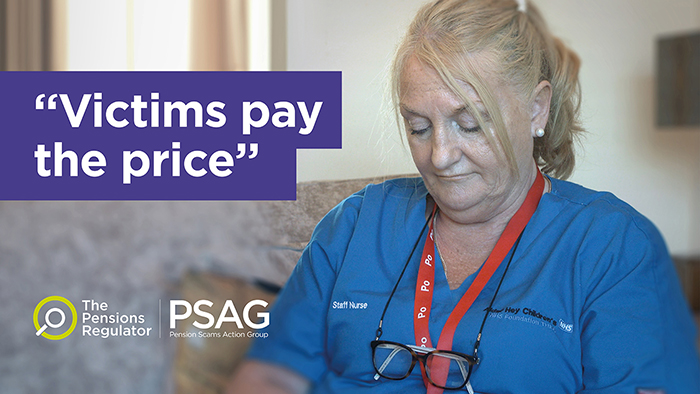

Pauline Padden, a nurse who lost her entire pension savings to fraudsters, speaks about the lasting impact of being scammed, and warns others not to fall victim.

The video issued today by The Pensions Regulator (TPR) in association with the Pension Scams Action Group (PSAG), urges the industry to take action to protect their members, asking “Are you doing all you can to protect people like Pauline?"

Children’s critical care nurse, Pauline, 60, lost her entire £45,000 pension savings to fraudsters after she was contacted out of the blue at a very vulnerable point in her life.

Pauline says: “I was devastated… It is a very real crime. There are victims and we do pay the price.

"If me telling my story helps one, two or three people from going through the same, it will have been worth it."

The video reminds trustees and administrators they are the first line of defence against pension scammers.

TPR is at the same time launching a video aimed at savers, with Pauline urging others to stop, think and ask themselves “Is it genuine or is it too good to be true?” before rushing to a decision.

TPR is urging trustees and administrators to share the new video aimed at savers with their members, to help them know how to spot and avoid scammers’ duplicitous tricks.

Pauline was one of 245 victims scammed out of a total of more than £13.5 million in pension savings after they were persuaded to transfer into fraudulent schemes.

Regulator secures prison sentences for scammers

The video campaign comes as a new case report from TPR, also published today, tells for the first time the full story behind the investigation which led to the conviction of Alan Barratt and Susan Dalton in April 2022 for their part in defrauding Pauline and others of their pensions.

The report traces how a single whistleblower report to TPR led to the pair being sentenced to a total of 10 years in prison. The pair were also banned from acting as company directors for eight years.

Gaucho Rasmussen, TPR’s Executive Director of Regulatory Compliance, said: “Pauline’s story starkly demonstrates how ruthlessly fraudsters will exploit victims’ vulnerability to make their ill-gotten gains.

“As our new report demonstrates, we take determined action to protect savers’ hard-earned pensions and bring fraudsters to justice.

“We urge industry to adopt higher standards of anti-scam practice to prevent fraudsters reaching savers like Pauline. Take the Pledge to Combat Pension Scams, deliver on it and report any suspicions to Action Fraud.

“Every report counts, providing TPR and our PSAG partners across law enforcement, government and the industry with the vital intelligence we need in the fight against fraud and criminality.”

Trustees should also consider making a report to us via the whistleblowing form on our website if any concerns arise, such as potential criminal offence.

TPR’s new RIR reports that following the completion of confiscation proceedings against Dalton and Barratt in January 2024, the government’s Fraud Compensation Fund has approved compensation for the pension schemes involved in this case. Members of these schemes will be informed of what this means for them individually in due course.

The video for savers has been created in three different lengths for industry to share with their members:

Notes to editors

- Scams Awareness Week is run by Citizens Advice in collaboration with the Consumer Protection Partnership (CPP), which includes Trading Standards and the Department for Business and Trade. It is an annual campaign aiming to create a network of confident, alert consumers who know what to do when they spot a scam.

- The new case report (Regulatory Intervention Report) traces how between 2012 and 2014, 245 individuals were persuaded to transfer pension savings totalling £13.7 million into 11 fraudulent pension schemes under the umbrella Friendly Pensions Ltd. 10 of these were controlled by Alan Barratt and Susan Dalton, who operated out of a call centre in Spain. TPR undertook regulatory, civil and criminal proceedings to prevent further harm to members, secure restitution of their savings and bring the fraudsters to justice. Following conviction, Barratt was jailed for five years and seven months while Dalton was sentenced to four years and eight months. TPR brought confiscation proceedings which saw the pair ordered to pay back assets totalling £34,781 in January 2024. Both have paid the full amount, which has been paid back into the schemes as compensation. An initial payment of £13.2 million has been paid by the Fraud Compensation Fund (FCF) to the schemes affected by the criminal enterprise. The full and final amount of compensation due to the schemes has still to be determined. Once this is determined, scheme members will be updated on what this will mean for them individually.

- The Pledge: More than 700 schemes have signed up to the Pledge to Combat Pension Scams, committing to take action to protect their members and follow the principles of the Pension Scams Industry Group (PSIG) Code of Good Practice.

- The Pension Scams Action Group, led by TPR, brings together government, industry, law enforcement and other partners, including Action Fraud, the FCA and the National Fraud Intelligence Bureau, to stop scammers and prevent savers falling victim. Together we co-ordinate intelligence-gathering and target action to combat pension scams and fraud through education, prevention and enforcement.

- Pension fraud reported between January to December 2023. Source: Action Fraud. There were 559 reports of pension fraud in total and £17,750,635 lost in 2023, with an average loss of £46,959 per person.

Victim location by geographic force area

| Local police force | Reported financial losses |

|---|---|

| Metropolitan Police Service | £2,265,304 |

| Greater Manchester Police | £726,170 |

| Thames Valley Police | £737,591 |

| Hampshire Constabulary | £677,938 |

| Kent Police | £312,090 |

| West Midlands Police | £1,727,159 |

| West Yorkshire Police | £1,143,705 |

| Merseyside Police | £150,524 |

| Surrey Police | £343,558 |

| Devon And Cornwall Police | £309,370 |

| Lancashire Constabulary | £501,454 |

| West Mercia Police | £353,428 |

| Cheshire Constabulary | £309,162 |

| Essex Police | £366,127 |

| Police Service Of Northern Ireland | £637,653 |

| Sussex Police | £98,532 |

| Avon & Somerset Constabulary | £69,775 |

| Cumbria Constabulary | £615,833 |

| Leicestershire Police | £225,862 |

| Northumbria Police | £210,010 |

| Gwent Police | £692,584 |

| Hertfordshire Constabulary | £193,254 |

| Lincolnshire Police | £304,893 |

| Suffolk Constabulary | £687,990 |

| Cambridgeshire Constabulary | £243,724 |

| Durham Constabulary | £155,827 |

| Norfolk Constabulary | £90,600 |

| Northamptonshire Police | £107,307 |

| Bedfordshire Police | £278,863 |

| Derbyshire Constabulary | £60,264 |

| Dorset Police | £176,558 |

| South Yorkshire Police | £20,600 |

| Staffordshire Police | £140,440 |

| Wiltshire Police | £157,611 |

| Cleveland Police | £120,081 |

| Dyfed Powys Police | £33,831 |

| Gloucestershire Constabulary | £55,046 |

| Humberside Police | £88,950 |

| North Wales Police | £38,290 |

| North Yorkshire Police | £58,300 |

| Nottinghamshire Police | £56,202 |

| Warwickshire Police | £295,362 |

| South Wales Police | £1,400 |

| Unknown | £1,911,414 |

| Total | £17,750,636 |

The Pensions Regulator is the regulator of work-based pension schemes in the UK. Our statutory objectives are to:

- protect members’ benefits

- reduce the risk of calls on the Pension Protection Fund

- promote, and improve understanding of, the good administration of work-based pension schemes

- maximise employer compliance with automatic enrolment duties

- minimise any adverse impact on the sustainable growth of an employer (in relation to the exercise of the regulator’s functions under Part 3 of the Pensions Act 2004 only)

Press contacts

Out of hours

This is for journalists only with a media enquiry. The below number will divert to our on call media officer.pressoffice@tpr.gov.uk

01273 648496