This guidance gives examples to show the principles behind how we will assess the fee for sections of collective defined contribution (CDC) schemes where the standard fee does not apply.

You should read this guidance alongside the applying for authorisation section of our CDC code.

Application for a single section scheme

The standard fee of £77,000 will apply to the first or primary section of the scheme regardless of content and must be paid by BACS transfer for us to accept receipt of a completed application and start assessing it.

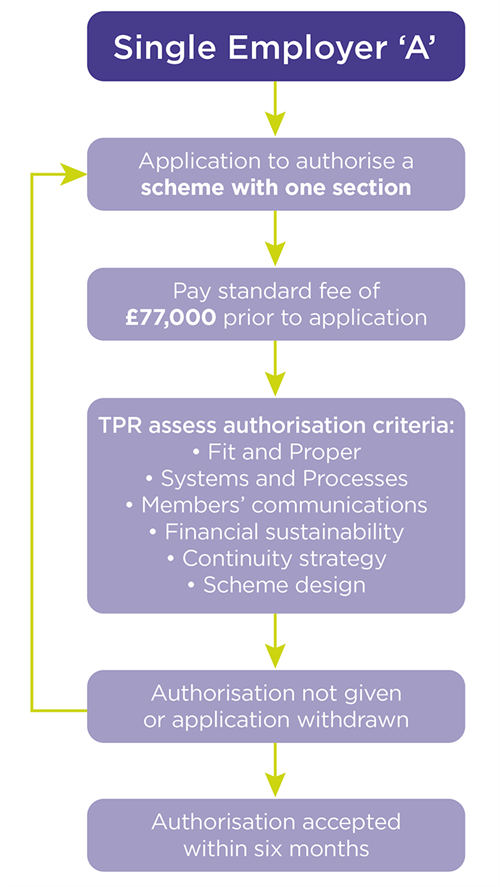

If an application is withdrawn during assessment and then resubmitted, the resubmission will be treated as a new application and the full standard fee must be paid for it. Diagram 1 illustrates the process.

Diagram 1: Process for assessing a scheme with one section

Application for one or more new sections of an existing scheme

If the trustees of an authorised scheme wish to apply for the authorisation of a new section, they must first submit a comparison report mapping out how the new section differs from any other section that has already been authorised.

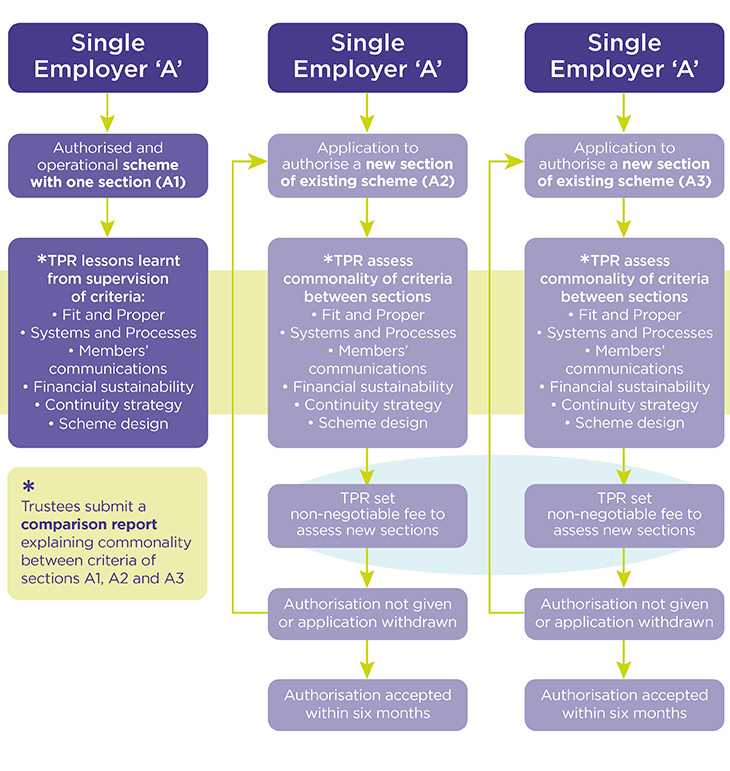

Diagram 2 shows that if it is the first new section to be added, then the comparison should be made against the primary section. If a second new section is to be added, the comparison should be made against both other sections, whether authorisation is sought separately or jointly.

We will rely on the comparison report to compare the level of duplication between sections and the level of original material we need to assess. The greater the level of duplication between sections, the less assessment time is likely to be needed and the lower the fee is likely to be.

The fee could be sensitive to economies of scale. For example, where the sections are identical or very similar and/or submitted simultaneously, we will only have to go through our internal assessment processes once. The existence of potential economies is highlighted in the diagrams by the light green oval shape. Likewise, when a new section is similar to an operational section, we may be confident about the additional assessment necessary because of the lessons we have learned from supervising the operational scheme.

After assessing the comparison report we will set a non-negotiable maximum fee based on the resources we will require to assess the application. Legislation is clear that the fee must be calculated on a cost recovery basis and not exceed the standard fee. On payment of this fee, we will begin assessing the application, a process that is limited to six months.

Diagram 2: Process for adding two new sections to an existing scheme whether done sequentially or simultaneously

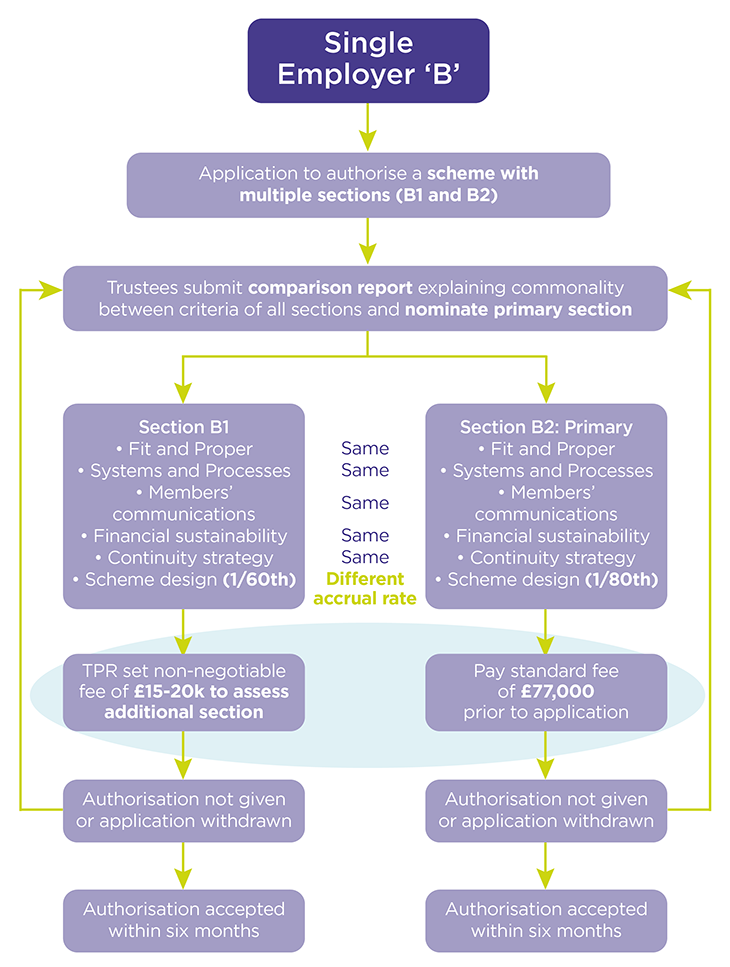

Application for more than one section at initial authorisation

The same principles apply when authorisation is sought at the outset for a multiple section scheme. Trustees will be expected to submit a comparison report with their application so we can assess the level of duplication across sections and set a non-negotiable fee. Leading up to submitting a first application we would expect any dialogue with us to cover the structure of the scheme and the relationship between sections.

The example in Diagram 3 shows trustees seeking authorisation of two very similar sections, with the only change being a difference in accrual rates. In such a case we would need to undertake additional actuarial analysis. The fee range shown is indicative as the level of additional analysis will be very dependent on the specifics of each section. For example, the ratio of accrual to contributions on one section with 1/60th accrual and 20% contribution is the same as another section with 1/80th accrual and 15% contribution. In such an instance the only extra actuarial analysis we would be likely to do is check there is a reasonable number of members in each section to enable the risk pooling to operate and fees to be spread over sufficient members.

Even if the sections were identical there would still be a floor to the fee of 20% of the standard fee, to cover our resource time to administratively check and assess the application.

If the primary section is not authorised, the trustees will need to nominate another section to become the primary section. The fee for assessing any resubmitted section will be calculated using the same process and a new comparison report must be submitted for a new application fee to be set.

Diagram 3: Process for assessing a new scheme with two sections

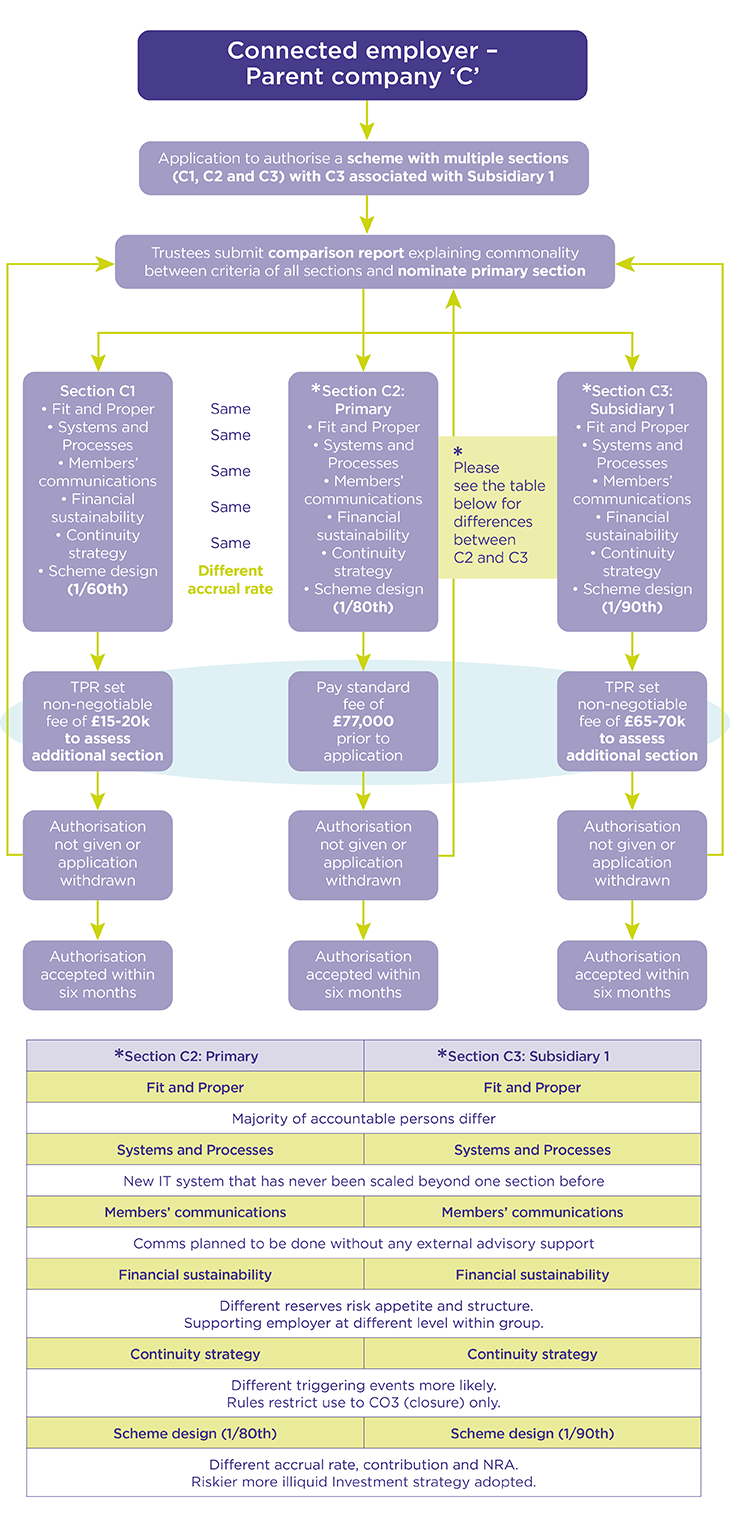

The example in Diagram 4 builds on the above example and adds a dissimilar third section that applies to a subsidiary company requiring further financial sustainability checks. All the criteria differ from the other sections to a significant degree that would require essentially a complete review and push the assessment resources we are likely to need close to the standard fee. On the upside there may be some additional scale economies that could marginally reduce the fee for section C1.

Diagram 4: Assessing a new scheme with three sections

What we expect from the comparison report

The comparison report is the key document that we will use to help us calculate the fee for all non-primary sections. We do not at this stage wish to be prescriptive as we would prefer you to explain the reasoning behind the new section and areas of overlap, although we do not rule out providing a template in the future.

Since the code commits us to informing you of the fee within seven days, the emphasis is on you to provide as comprehensive a report as you can to help us evaluate the resources we will need. For existing schemes, we recommend that you have an early conversation with your supervisor to discuss how the new section or sections differ so that we can feed back the level of detail expected for each of the authorisation criteria in the report. For new schemes with multiple sections, we recommend early discussion with us, especially if the intention is for the scheme design to significantly vary between sections.

It would be preferable for the comparison report to be presented as a table so that it is easy to cross reference with the authorisation criteria. Table 1 below provides a high-level example in relation to the governance of the investment function for a new scheme seeking authorisation for three sections. In this example you can see we are only interested in how two of the sections differ from the primary section that is tied to the standard fee. Section B is clearly identical to the primary section so the additional resources required will be limited to an administrative comparison check rather than new analysis. Section C on the other hand is significantly different from the other two sections and will require further resource-intensive analysis.

Table 1: High level example of how an applicant may set out comparison report between sections

| Primary section | Description | Reference | |

|---|---|---|---|

| Investment function |

Accountable person |

Name | Page and paragraph |

| Significant role |

Name | ||

| Name | |||

| Aims and objectives (investment strategy including ESG) |

Summary | ||

| Management information requirements |

Summary | ||

| Managing processes |

Summary | ||

| Resources | Summary | ||

| Advisers / investment managers |

Name(s) | ||

| TPR assessment of cost recovery |

Standard fee | ||

| Section B | Commonality | Reference | TPR resource assessment | |

|---|---|---|---|---|

| Investment function |

Accountable person |

Same | Page and paragraph | Administrative and approval checks |

| Significant role |

Same | |||

| Same | ||||

| Aims and objectives (investment strategy including ESG) |

Same | |||

| Management information requirements |

Same | |||

| Managing processes |

Same | |||

| Resources | Same | |||

| Advisers / investment managers |

Same | |||

| TPR assessment of cost recovery |

Minimum | |||

| Section C | Commonality | Reference | Brief description of difference | Cross reference to any secondary effect on other criteria | TPR resource assessment | |

|---|---|---|---|---|---|---|

| Investment function |

Accountable person |

Different | Page and paragraph | Same skill set | – |

Assess fitness and propriety, role clarity |

| Significant role |

Different | Expertise in illiquids | ||||

| Same | – |

Assess person capacity |

||||

| Aims and objectives (investment strategy including ESG) |

Different | Portfolio mix, proactive net zero target |

Scheme design, asset liability modelling, member comms |

Analysis of additional advice and work done by actuary, investment consultant and business adviser |

||

| Management information requirements |

Different | Different risk metrics |

Risk budget, contingency plans and liquidity profile |

|||

| Managing processes |

Different | Cashflow management |

||||

| Resources | Higher | More active management and aggressive return |

CALP and continuity option |

|||

| Advisers / investment managers |

Different | |||||

| TPR assessment of cost recovery |

High | |||||

The more detail you give in the table about the differences and similarities between sections, the easier it will be for us to break down the intensity of assessment work involved and the greater certainty we will have over setting the fee and avoiding the need to add a risk premium. It should not be assumed that the calculation of our fee is linear (ie each criterion takes the same amount of time to evaluate). Due to the interconnectivity of criteria, a small but significant change in one criterion could also impact your thinking in other criteria. Therefore, we also recommend that you cross-reference any such interdependencies in the comparison report.

Future developments

We will update this guidance as necessary to manage the following two issues.

Changing regulations

We recognise that the present regulations bind employers to open a new section if they wish to change a qualifying benefit, and this in turn increases the assessment fee. It is highly likely that as the CDC landscape evolves to allow for multi-employer and commercial schemes, the regulations will change to accommodate multiple contribution and accrual rates in the same section. Single and connected employers will need to make a judgement when scoping a scheme whether to wait for such flexibility in order to reduce any potential assessment fee outlay.

Category pricing

We appreciate the need where possible to provide more certainty over the likely fee to be charged for an application. We will look to provide some form of category pricing for each authorisation criterion. The speed with which we can adopt such an approach will depend on the number and type of schemes that come forward and our confidence that any category price correctly reflects the breakdown of resources incurred.