From 1 October 2021, new regulations came into effect for trustees of certain schemes aimed at improving governance and reporting of climate-related risks and opportunities.

Reports under these regulations started to be published from mid-2022. Here, we set out our preliminary observations and feedback to industry, based on our review of a selection of the tranche one climate-related disclosures published by occupational pension schemes

Published: 23 March 2023

You can save the contents of this page as a PDF using your web browser. Open the print options and make sure the destination/printer is set as 'Save as PDF':

Introduction

Who this review applies to

We expect trustees, advisers, and in-house teams to carefully consider our findings when preparing future reports under the Occupational Pension Schemes (Climate Change Governance and Reporting) Regulations 2021 (the Climate and Governance Regulations).

Climate change poses risks and opportunities to all pension schemes. Trustees of smaller schemes that are not subject to these regulations, may still find our findings useful in improving their management of climate-related risks and opportunities.

Why we conducted this review

There is no doubt that climate change will continue to pose a core financial risk to business, the economy, and markets for some time to come, but the shift towards low-carbon economies also presents opportunities.

Trustees will already be managing financial risks including climate change as a financially material consideration. Unless properly managed, climate-related risks have the potential to impact scheme investments, funding and the employer covenant, which could leave some savers, in some cases, facing a poorer retirement.

From 1 October 2021, the Climate and Governance Regulations required trustees of certain schemes to consider climate-related risks and opportunities in more detail than before. Under the requirements, trustees must identify, assess, and manage climate-related risks and opportunities, and report on what they have done. These reporting requirements are developed from the recommendations of the Taskforce on Climate-Related Financial Disclosures (TCFD).

This is a new area of regulation, and we know that expectations on trustees will change over time, even within the legislative framework. We recognise this is new ground for many trustees and their advisers, and there is a steep learning curve regarding knowledge, regulatory requirements and changing market practices.

We specified in our Climate Change Strategy and blog in June 2022 that we would review climate-related reports published by schemes in tranche one and share emerging good practice. However, we also said that we would regulate and enforce these requirements, where necessary.

This publication sets out our initial findings and observations following our review of tranche one reports, including next steps.

What we found

Overarching observations

From our review of reports so far, we found that:

- almost all reports were published on time

- reports ranged in length from 10 to 85 pages, with an average of 34 pages

- almost all are substantial documents, which showed an encouraging level of trustee engagement with the new requirements

- some reports included helpful non-technical summaries for savers

Trustee action

In this first year of reporting trustees will have spent significant time and effort calculating and disclosing emissions data. This may have restricted the time available for trustees to interpret and take action on the data, as some reports put less emphasis on these aspects.

Nonetheless, there were some good examples of trustees taking action, including:

- planning climate and sustainability training for trustees and others involved in scheme governance about climate-related risks and opportunities

- developing a trustee policy on investment beliefs relating to climate change

- conducting due diligence and checking advisers' climate credentials

- working with investment managers to obtain better data

- allocating more funds to sustainable investments

- using stewardship to manage climate-related risks

- switching to climate-tilted pooled funds

Data challenges

We acknowledge that data quality and coverage remain a challenge. However, this is likely to improve over time as investment firms adapt to the new data capture and reporting requirements and as trustees and their advisers learn from experience.

Data quality will continue to be a challenge as trustees begin reporting on scope 3 emissions (required from the second year that trustees are subject to the regulations). We also recognise concerns that reported emissions of investments will likely increase as data coverage improves. Trustees should explain limitations in their data and any subsequent changes resulting from improved data coverage.

General issues for improvement

There were several overarching issues that commonly appeared in reviewed reports. We ask trustees to ensure these points are considered when producing their next report.

Some reports lacked sufficient background information on the scheme which made disclosures difficult to interpret, particularly for more complicated arrangements such as hybrid or sectionalised schemes. It would be useful for reports to explain:

- for DB schemes, whether there are different sections and if so, whether the trustee considered they have similar characteristics and so could be grouped for reporting

- for DC schemes, which arrangements the trustees consider to be popular[1] arrangements

- for Hybrid schemes, both points above

For schemes with more than one DB section or popular DC arrangement, disclosures of strategy, scenario analysis and metrics activities were not always provided at the appropriate level. For further information, read paragraphs 19 to 25 of part 2 of the DWP's statutory guidance for more details.

Accessibility issues were identified for some reports, which could make it difficult for savers and others to find and access reports online, for example:

- some reports were difficult to locate using search engines

- long or complicated web addresses (URLs) made it difficult to retype the address from printed material

- some reports were not fully accessible to people with different needs; 27 of the reports we reviewed failed at least 6 criteria in a standard accessibility check using commercially available software. One scheme uploaded a scanned PDF document, not compatible for users using reader accessibility software, and one other report could not easily be printed

For further information, trustees should read paragraphs 6 to 19 of part 4 of DWP's statutory guidance for more details on accessibility requirements.

We believe it would be useful for trustees to collect member feedback on their first climate reports, to see how they can be made more useful to members.

Findings

Our high-level review was seeking to identify and provide feedback on emerging good practice. It is not a compliance check to determine whether a report meets the requirements of DWP's statutory guidance or the Climate and Governance Regulations. Therefore, we have only referred to DWP’s statutory guidance where requirements were commonly missed by schemes.

We remind trustees that they must have regard to the DWP's statutory guidance when complying with the Climate and Governance Regulations. Some reports suggested trustees had not done this consistently. In this section, for each of the reporting areas, we set out:

- required information that was missing

This includes disclosures described as 'must' in the Statutory Guidance. All trustees need to ensure these points are included in their next reports. - other areas for improvement

This includes areas of reports that did not meet our expectations. We expect trustees to consider these points to improve the overall quality of reports. - examples of good practice we observed

This includes points that, while not legally required, we considered made the reports more useful or understandable for readers. Trustees wishing to develop their reports further should consider incorporating these examples in their reports.

Governance

This was generally a strong section in reports. Most reports provided a clear description of how responsibility for climate change matters were assigned. Reports generally described the roles of various parties involved in managing climate change risk, for example in-house investment teams, investment managers and investment consultants.

Required information that was missing

The roles of those undertaking scheme governance activities, other than trustees, in identifying, assessing and managing climate-related risks and opportunities relevant to those activities

This point was often not addressed. 'Undertaking governance activities' means making scheme-wide decisions. This may be because there are no such persons – for example only the trustees make scheme-wide decisions. If this is the case, this should be briefly stated. Where there are other parties (for example a dedicated pensions team within the sponsoring employer or scheme funder), these roles should be described and the extent to which any conflicts of interest are being managed.

The processes the trustees have established to satisfy themselves that the person undertaking, advising or assisting takes adequate steps to identify and assess any climate-related risks and opportunities which are relevant to the matters on which they are advising or assisting

In practice, this means describing how trustees assess the credentials and competence of their employees or advisers with respect to climate change risk. This was most commonly included for investment consultants, but less commonly for other advisers and in-house teams.

Other areas for improvement

- The reports should make clear how often and to what extent climate change risk is discussed by the trustees.

- They should also include more specific examples of the types of information received by the trustees on climate change risks and opportunities during the year.

Good practice we observed

- Clear descriptions of the trustees’ high-level approach to climate change, for example by considering investment beliefs around climate change, or reviewing and updating the schemes’ Responsible Investment Policy.

- Carrying out a skills audit or gap analysis, to identify the specific areas where trustee training is needed.

- Clear descriptions of the roles performed by individual consultancy firms or advisers.

- Robust processes for reviewing the competency of in-house teams or advisers, which could include:

- setting climate-related objectives for the investment consultant

- explicitly considering climate change in the annual review of all advisers (including Scheme Actuary and covenant adviser)

- explicitly considering climate risk management practices when tendering for new asset managers or advisers

- incorporating requirements to measure carbon emissions of assets into Investment Management Agreements with asset managers

- making use of the Investment Consultants Sustainability Working Group’s guide on assessing the climate competency of investment consultants

Strategy and scenario analysis

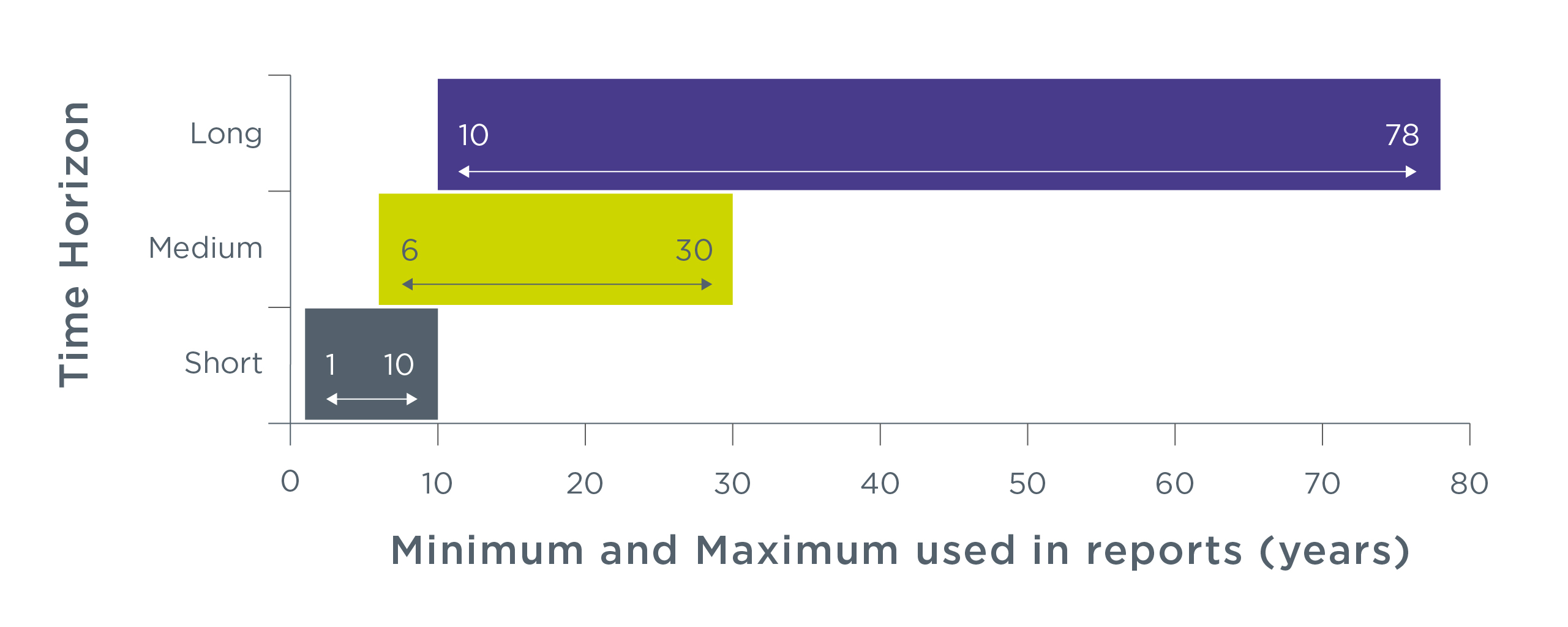

This section of the reports showed a wide range of approaches. While many included well-reasoned comprehensive information, others took a minimum compliance approach. The time horizons trustees took for their short, medium and long term varied significantly even for similar types of schemes, as shown below.

Source(s): TPR

For their scenario analysis, most schemes carried out a quantitative analysis (rather than qualitative). The most common scenarios chosen were broadly aligned with the three described in the statutory guidance: an orderly transition, a disorderly transition and a 'hot house' world. A smaller number of reports included 'Optimistic' scenarios (where temperature rises are limited to 1.5oC and the transition is smoother than anticipated) and 'Base case' scenarios (where a limited transition takes place and temperatures rise 2°C to 2.5°C).

Required information that was missing

Identifying and assessing the relevant risks and opportunities for each time horizon (short, medium and long-term)

Most reports included a list of risks and opportunities, but many did not consider which time horizons these were relevant to.

The impact of climate-related risks on the scheme’s investment strategy and funding strategy

Reports often described the potential impact of climate risks on asset values, rather than on the trustees’ investment strategy. The impact on investment strategy means considering factors such as the strategic asset allocation and choice of investment mandates, in order to mitigate risks or capture opportunities.

Similarly, some DB scheme reports described the impact on liability values, rather than the funding strategy. The impact on funding strategy means considering actions such as reviewing the long-term funding objective or adjusting the balance between employer contributions and investment returns, in light of the risks identified.

Considering the impact on the employer covenant

For most DB schemes, the employer covenant is an important part of the funding strategy. Therefore, we expect the majority of DB scheme reports to disclose the trustees’ assessment of how climate change could impact the employer covenant. If the trustees conclude this assessment is not relevant or material for their scheme, this should be briefly stated with reasons.

Other areas for improvement

- Consideration of how climate-related opportunities could influence the investment strategy (rather than focusing solely on risks).

- Several schemes used different scenarios for different parts of the portfolio, or different scenarios for assessing the assets and employer covenant. This tended to make the analysis more difficult to interpret. We suggest trustees aim to set a single set of scenarios that are used consistently for all parts of the analysis.

- For DB schemes, the scenario analysis should consider the impact on liabilities, and on the employer covenant, in the chosen scenario. Some DB schemes’ analysis only considered the impact on assets.

- Where trustees state that the scheme’s strategy is resilient under the scenarios considered, we would like to see clear evidence to support that statement. We noted some reports disclosed a large adverse impact under one scenario, but also stated that the scheme’s strategy was ‘resilient’. These conclusions were difficult to reconcile.

Good practice we observed

- Many reports linked the risks disclosed over each time horizon to the specific asset classes held by the scheme and considering how the allocation will evolve over the time horizons, rather than providing a generic list of risks.

- In the scenario analysis for DB schemes, trustees considered the impact on asset, liabilities, and covenant in an integrated way, using consistent scenarios.

- Many reports also disclosed the impact on the overall funding level, allowing for changes to both assets and liabilities.

- In the scenario analysis for DC schemes, reports often showed the impact on the expected pension pot at retirement for a range of members of different ages.

- Reports often explained the underlying reasons for the impacts under each scenario. As an example, one report's scenario analysis showed liabilities increasing under an Orderly Transition scenario. This was explained by assumed higher inflation, resulting from higher carbon prices and an increase in government investment.

- Trustees’ conclusions from carrying out the scenario analysis were also explained in many reports.

More guidance on assessing climate impact on employer covenant will be included in updated covenant guidance expected to be released later this year. This will include further guidance on the identification of ESG risks and opportunities, how to assess the impact of ESG risks and opportunities on the employer covenant, management of ESG risks identified and examples to assist in the application of the guidance.

Risk Management

This tended to be a shorter, narrative section, reflecting the requirements under this pillar. Most trustees met the requirements through their existing risk management framework (for example, risk registers) rather than setting up separate climate risk management dashboards.

Required information that was missing

Trustees must describe the processes they have established for identifying, assessing and managing climate-related risks in relation to the scheme

This disclosure is about describing trustees’ processes. Occasionally trustees just published a list of climate-related risks, which does not address this requirement. More commonly, trustees included good information on the management of risks but did not describe how new and emerging risks are identified, and who is responsible for this.

Other areas for improvement

- We think users of reports would find it useful to see specific examples of activities or discussion that took place during the year. This could be any specific new risks that were identified, or specific actions taken to manage risks (for example a change in investment manager).

- Master trusts may wish to set out processes for assessing the potential impact of climate-related risks on the scheme funder.

Good practice we observed

- Reports often set out the trustees’ approach to stewardship (as a risk management tool), with some specific examples of engagements with companies that took place on behalf of the trustees during the year.

- For DB schemes, details of how climate-related risk to the employer covenant is assessed and managed and risks affecting the investments were also included by trustees.

Metrics

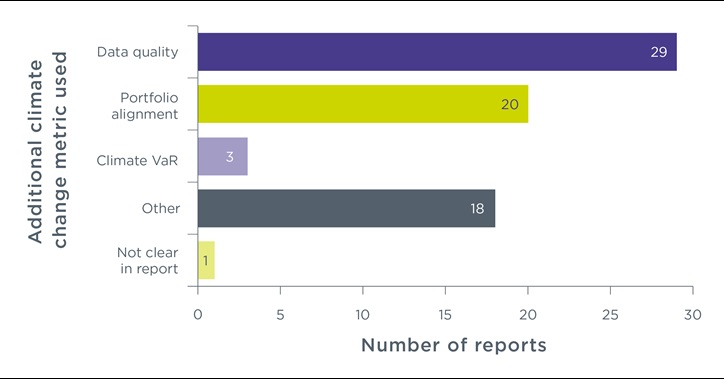

Reports generally included at least three climate metrics, as required. However, it was sometimes unclear how much of the scheme’s assets were included in the metrics. The most popular choice for the Additional Climate Change metric was a measure of data quality. Many schemes chose to disclose a portfolio alignment metric, which is a required metric in reports from 1 October 2022.Source(s): TPR

Required information that was missing

Where trustees are unable to obtain data to calculate the metrics for all of the assets of their scheme, they must explain why this is the case

Reports generally note where data is incomplete, but sometimes do not state clearly which asset classes this applies to, or why this is the case.

Other areas for improvement

- More prominent stating of the proportion of assets, and the asset classes, for which emissions data was available.

- Explanation of the steps being taken by trustees to address data gaps. Reports often cited general industry-wide issues with data quality, but few disclosed specific steps trustees are taking to seek improvements.

- Explanation of why the trustees chose a different “Additional Metric” from those listed in the statutory guidance, where this was the case.

Good practice we observed

- Trustees set out the scheme’s high level asset allocation to asset classes. Where reports included this, it was generally easier to understand where data was missing, and how material the gaps were in the context of the total size of assets.

- Key figures were summarised in a single, summarised single table (for each section or popular default fund as appropriate) and more granular data was moved to an appendix.

- Metrics were provided for prior years to show trends over time (where this data was available, or trustees had been collating this data previously) as well as an explanation of the reasons for any significant changes from the prior year.

- Using estimates to increase the data coverage, e.g., using proxies for certain asset classes.

- Clear warnings were provided for readers where emissions figures were based on partial data. For example, explanation that disclosed emissions may increase as more data becomes available and is not necessarily caused by a real-world increase in emissions.

Targets

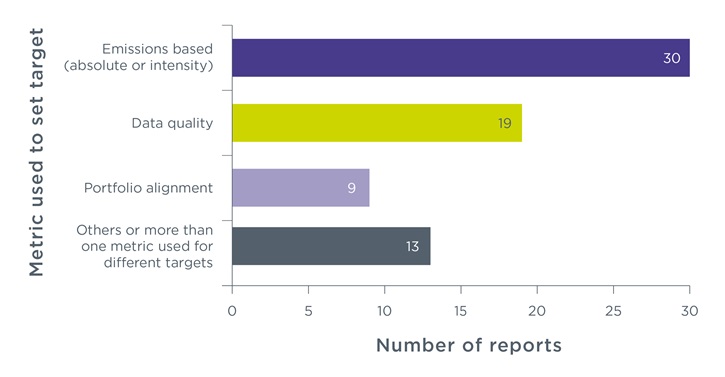

As trustees have discretion to set a climate-related target in any way they see fit, there were few issues in meeting the mandatory requirements in this area. The most common type of target was reducing the carbon emissions associated with the scheme’s assets (either in absolute terms, or emissions intensity terms), as shown below.

Source(s): TPR

Required information that was missing

All reports we considered included the required disclosures in this area.

Other areas for improvement

- Explanation of the steps trustees are taking to achieve their target.

Good practice we observed

- Clear explanation of why the target was chosen and how it is aligned with trustees’ fiduciary duties, for example how it is contributing to reducing risk or capturing opportunities.

- Although this is the first-year trustees were required to calculate climate metrics, some trustees also calculated metrics for an earlier ‘comparator’ year. This allowed them to disclose their performance against their target in this first report and note any trends over time.

Net zero targets

- 43 out of the 71 reports we analysed had set a formal “net zero” target. This represents around £450bn of assets under management and over 18 million savers.

- of those schemes with formal Net Zero targets, 5 aim to reach this by 2040 or earlier, 1 by 2045 and the remainder by 2050. Most supplement this with a clear interim target, as required by the statutory guidance. This is commonly to reduce the carbon intensity of the assets by a certain level by 2030.

We welcome the popularity of these targets. We believe they can be appropriate step for trustees, by helping to position their investment portfolio to be robust to potential economy-wide changes from a climate transition. It also signals support of the goals of the Paris Agreement, which if met would reduce longer-term systemic risks to scheme investments from the physical effects of climate change. As these targets are new, most trustees are yet to work out the full details of they will be achieved. As trustees gain a better understanding of how to approach the transition to net zero, we would expect to see more detailed transition plans being developed.

At the same time, we are clear there is no requirement for trustees to set a net zero target. Targets are primarily used by trustees to track their efforts to manage climate change risk exposure and take advantage of climate change opportunities. Trustees are likely to require legal and professional advice in this area.

Next steps

We are pleased to see climate change moving up the trustee agenda as a result of the Climate and Governance Regulations. Trustees will need to understand what their climate change assessments tell them and incorporate them into the scheme's overall decision-making process. This includes being used as a key input into investment and implementation decisions, including - for DB - in relation to the scheme's funding strategy.

What you need to do

Trustees, advisers, and those preparing climate change reports must ensure any gaps in required disclosures are addressed in future reports. To improve the quality disclosures and make reports more user-friendly, we also expect our wider findings and comments to be taken into account.

Reminder

Trustees are reminded that in their next reports, they will need to report on a new portfolio alignment metric, and trustees reporting for the second time will need to consider Scope 3 emissions.

Please refer to DWP’s statutory guidance and TPR’s climate change guidance for more information about preparing reports, including on Scope 3 and Portfolio Alignment Metrics.

Evolving regulatory approach

Except in a small number of cases, our review of climate change reports has so far been encouraging and we expect the quality of reports to improve year-on-year as trustees and wider industry evolve market practice. In that regard we hope the findings of our review serve to highlight where good practice is already emerging as the requirements are bedded in.

Unfortunately, there were a small number of reports we reviewed where the quality of the disclosures was disappointing. We have previously set out that we would be unlikely to issue penalty notices to trustees of schemes that are required to publish their climate related reports in the first tranche, except where:

- the report has not been published on a publicly available website, accessible free of charge, within 7 months of the relevant scheme year end (a mandatory penalty) or

- it is clear that the trustees have not made a genuine effort to comply with the Climate and Governance Regulations (a discretionary penalty)

However in future, we will consider issuing penalty notices where reports fail to meet Climate and Governance Regulations. Any failure to publish a report as required is subject to a mandatory fine of at least £2,500. When it is clear that trustees have not complied with the regulations in preparing their report, we may issue a further discretionary penalty of up to £5,000 for individual trustees and up to £50,000 for corporate trustees.

Future developments

Climate-related risks and opportunities will continue to dominate the agenda for government, regulators and policymakers for some time to come.

We will continue to work alongside the government and other financial regulators in our work on climate-related risks and opportunities, and stewardship practice.

We will support the DWP with their review of mandatory climate related disclosures taking place later in 2023. It is expected a review of requirements on disclosures on stewardship activities will take place at the same time. Our insights and experience in regulating climate-related disclosures will be shared to inform the DWP's review.

We recognise that it has been a steep learning curve for many trustees in preparing their climate change reports and integrating climate change into their scheme's governance and risk management arrangements. This remains a dynamic and evolving area. Trustees will need to continue to develop their knowledge and understanding of climate, ESG and wider sustainability issues (including biodiversity) as industry practice develops.

Appendix: what we did

The governance and reporting of climate-related risks had a phased introduction, initially applying to trustees of authorised master trusts and larger schemes with relevant assets of £5 billion or more from 1 October 2021 (tranche one). From 1 October 2022, the requirements were extended to trustees of schemes with relevant assets of £1 billion or more (tranche two).

The quantitative results in this publication are based on 71 published climate-related reports from tranche 1 which can be broken down as follows:

By scheme publication deadline, which falls due seven months after each scheme year-end:

- 24 with year-ends 31 December 2021 (publication deadline 31 July 2022)

- 41 with year-ends 31 March 2022 (publication deadline 31 October 2022)

- 6 with year-ends 5 April 2022 (publication deadline 5 November 2022)

- 21 DB only schemes

- 26 authorised master trusts

- 24 Hybrid schemes with DB and DC sections

The quantitative data in published reports was in some cases ambiguous, or open to interpretation in different ways, so other analyses may arrive at slightly different figures. As such, the results in this publication should only be considered as a broad overview of industry practice.

The qualitative observations and commentary in this publication are based on 45 published reports.

We intend to review all reports when these are published by tranche one schemes (around 90 in total). The reports reviewed so far indicate that they are generally representative, and we do not anticipate any significant changes to the findings in this publication after reviewing the remaining tranche one reports.

As part of our qualitative review, we considered:

- the quality and consistency of reporting against the regulations and DWP's statutory guidance

- how well trustees understood the range of climate-related risks and opportunities for their scheme, and explained the results of their analysis

- how trustees intend to address the risks and opportunities they have identified, proportionate to the scheme's arrangements and other risk exposures

To contextualise the findings of our review, we engaged industry groups and investment consultancies. This provided us with insight into the way reports were prepared, and the issues encountered. We have used this engagement to validate our views on what trustees did well, and improvements we would like to see.

Footnotes

- [1] DWP’s statutory guidance, paragraph 20 defines this as: A popular arrangement is considered to be one in which £100m or more of the scheme’s assets are invested, or which accounts for 10% or more of the assets used to provide money purchase benefits (excluding assets which are solely attributable to Additional Voluntary Contributions).

- [2] DC schemes are expected to be included in the tranche two reporting cycle, which applies to schemes with relevant assets of more than £1 billion from 1 October 2022.