The Pensions Regulator’s Corporate Plan 2024 to 2027 sets out our direction for the next three years, explaining how we will protect savers' money, help to enhance the pensions system and support innovation in the interests of savers.

Published: 3 May 2024

Message from the Chair and the CEO

We are in a period of change. One where the pensions market is rapidly shifting towards fewer, larger, pension schemes. This brings new risks and opportunities for savers and the economy. We have been clear on the need to protect savers’ money, enhance the pension system and innovate in savers’ interests. This corporate plan demonstrates how these words translate into action.

To protect savers, we will continue to develop our value for money framework so that all savers receive value from their pensions, implement the new defined benefit (DB) funding regime, and ensure new DB consolidators provide the security and safety savers need. We will enhance the system by building a rich data picture of the role pensions play in the wider financial ecosystem, raising standards of trusteeship, and changing how we approach supervision. We will also increase our focus on new and increasingly significant professional trustee entities.

We will encourage innovation in savers’ interests by helping schemes to support defined contribution (DC) savers into retirement. It is important that new DB models and options for consolidation protect savers and improve outcomes and security at retirement.

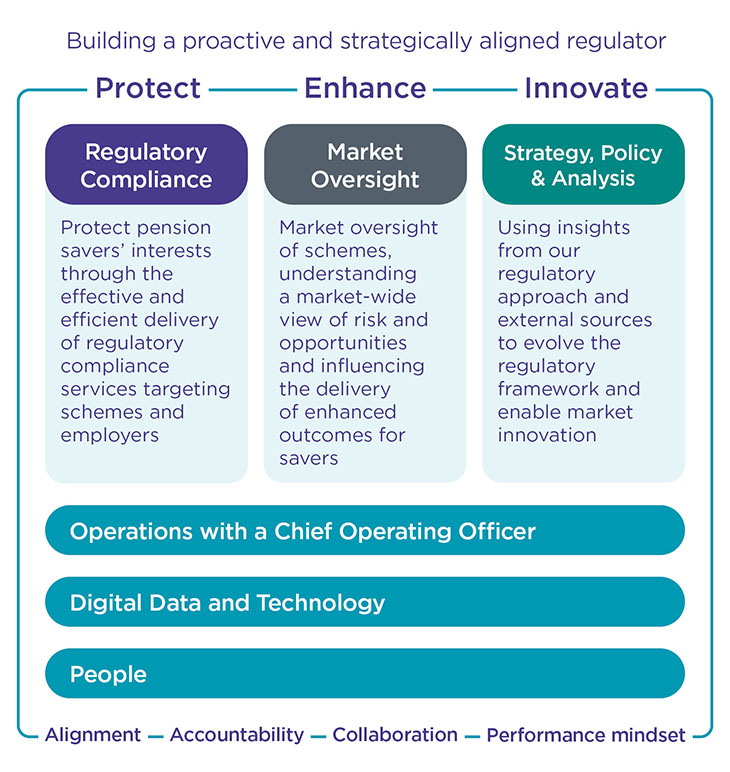

To make all of this happen we are aligning our structure to our strategic priorities and essential functions.

We will direct our resources and talent squarely towards delivering saver-focused outcomes and this will involve investing in our people, improving our systems, and creating three new regulatory directorates.

- Regulatory Compliance – protecting savers’ money through the effective and efficient delivery of regulatory compliance services, targeting schemes and employers.

- Market Oversight – enhancing the market through strategic engagement with schemes and others who influence delivery of pension savers’ outcomes.

- Strategy, Policy, and Analysis – using insights from our regulatory approach and elsewhere to evolve the regulatory framework and support innovation in the interests of savers.

This evolution will enable us to be more market-focused, even closer to developments in the pensions market and able to positively influence change as it unfolds. Industry should expect us to interact with them differently, providing greater assurance to savers, and improving our efficiency and effectiveness over time. Where we find bad actors, we will not be afraid to tackle them, developing quicker routes to enforcement to ensure savers are protected.

We will be data-led and digitally enabled, to identify where we need to focus our efforts and understand the complex decisions that trustees are making, as well as the impact they can have on savers’ pots and the UK economy as a whole. We will develop multi-disciplinary teams that can focus on the themes and the risks in the market, and we will learn from every interaction to update our risk analysis and our regulatory approaches.

This corporate plan articulates how we will deliver better outcomes for the millions of people that rely on a pension to support them in older life. The pensions landscape is changing, we will change with it.

Challenges in the pensions landscape

Over the past year, global instability has continued to fuel UK inflation and a monetary policy response in the shape of increased interest rates. The associated cost pressures have affected consumers and businesses alike, and the pensions industry has not been unaffected. Employers sponsoring pensions have had to manage these commitments against increased production costs, while rises in the cost of living have created a challenging environment in which to save.

Against this backdrop, we continue to observe consolidation in the pensions industry. We welcome the shift towards fewer, larger, well-run schemes in the market that offer the ability to invest across a range of assets in their members' interest and have the scale to offer administrative efficiency and good governance.

Another notable shift relates to the increase in professional trustees and concentration of the trustee industry. Mergers and acquisitions across professional pensions companies have made these companies more systemically important for the delivery of good outcomes.

The third landscape shift that will become increasingly relevant over the forthcoming years relates to retirement itself. Automatic enrolment (AE) has led to a rapid expansion of the DC market. It is crucial that as savers progress towards retirement they have an appropriate choice of decumulation pathways open to them.

Our priorities for the next three years

In setting our priorities for the next three years, our starting point as a risk-based regulator is an assessment of risks and considerations against our own risk appetite.

Our vision for the industry

Our purpose at TPR is to protect pensions savers’ money, to enhance the pensions system and support innovation in savers’ interests. We recognise that the market is consolidating, governance is becoming increasingly professional and the entire savings journey will need to offer both security and value.

To this end, our vision for the industry is one in which there are fewer, well-run schemes, delivering good outcomes – from joining a pension through to retirement.

Fewer schemes, delivering good outcomes for savers

We will support consolidation in the pensions market where it offers value and security to savers. This means:

- driving value across DC schemes by evolving our supervisory approach to master trusts, developing the joint Financial Conduct Authority (FCA) and TPR value for money framework and our enforcement of the value for members framework across smaller schemes

- working with the Pension Protection Fund (PPF) where DB schemes are not likely to be able to meet their liability commitments

- engaging with the market to ensure good quality consolidation vehicles, such as the emergent collective DC market

Schemes are well run

Across the industry, we expect continuous improvement in the capabilities of those running schemes and increased emphasis on the quality of scheme administration.

- In the case of trusteeship, we will ensure high standards through closer engagement with the professional trustee industry and the wider promotion of the general code.

- As the Task Force on Climate-related Financial Disclosure (TCFD) reporting requirements are embedded, we will turn our focus towards improving the quality of reporting and the understanding of risk.

- We expect those running schemes to ensure high-quality delivery of administration services and enable compliance with their pensions dashboards duties.

- Recognising the challenges related to liability-driven investments (LDI) in 2022, we will work with other regulators to ensure that the pensions industry does not pose a systemic risk to the wider financial system.

Good outcomes – from joining a pension scheme

We will ensure that employer compliance with AE duties remains high, including re-enrolment and making timely and accurate pensions contributions.

Good outcomes – through retirement

Savers’ money must be protected at retirement and the options available to them should offer good outcomes. This means that we will:

- monitor and work with DB schemes as they progress towards low dependency funding, buy-out and/or consolidation

- work towards ensuring DC savers approaching retirement are offered appropriate choice in decumulation enabling them to access their pension pots

- protect savers from scams including by enabling them to make good decisions which in the longer term will be supported through an effective deferred small pot consolidation regime

Our key priorities for 2024-25

Our key priorities reflect our purpose to protect, enhance and innovate in savers' interests and have been set to support our ambition for fewer, well-run schemes, delivering good outcomes, from joining a pension through to retirement.

We protect pension savers’ money

- Implement the new DB funding regime.

- Support the Department for Work and Pensions (DWP) and the PPF with regard to options for closed DB schemes including surplus sharing and a public sector consolidator.

- Work with the DWP on potential legislation for superfunds and assess alternative models as they emerge.

- Develop the value for money framework with the DWP and the FCA.

- Focus on scheme compliance with the value for members assessment.

- Embed multi-disciplinary approach to regulating, building on our work with master trusts.

- Continue to ensure high levels of compliance in AE.

- Lead the multi-agency Pension Scams Action Group.

We enhance the pensions system

- Continue the delivery of the pensions dashboards programme.

- Address market issues of administration.

- Investigate data quality issues.

- Focus on the quality of trusteeship and governance.

- Embed financial stability and external risk functions.

We innovate in savers’ interests

- Collaborate with government and industry on decumulation products and pathways.

- Deliver a regulatory framework for CDC models.

We invest in our people and embrace change

- Deliver critical tools and systems to support efficient and effective regulation.

- Continue to engage our team as we evolve.

- Migrate to our new structure.

- Embed new ways of working including senior managers regime and inter-disciplinary working.

The key challenge in 2024-25 will be embedding the new regulatory funding regime for DB schemes while also increasing our attention on DC value for money, good governance and administration.

Managing the DB journey

Implementing the new DB funding regime will require investment in our data and systems infrastructure, and a commitment to enhancing our market oversight as the new DB regulations and funding code comes into force in 2024. This includes engagement with the market to discuss expectations and how to demonstrate compliance with the new regulatory regime.

A key aspect of ensuring security among DB schemes is supporting a market for consolidation and risk transfer. To this end, we will work with the DWP to support the development of any future legislation related to DB superfunds.

Buy-out is not the only end game option for DB schemes. The market for DB consolidation options, including capital-backed journey plans, DB master and multi trusts and superfunds, among others, has been rapidly developing in recent years. We have been closely engaging with proponents of these options and as a result we plan to publish guidance later this year. The guidance for trustees and employers considering these options will highlight features of these solutions and what they should consider when assessing these propositions for their schemes.

We recognise not all schemes will achieve low dependency funding or be looking to consolidate through consolidation vehicles that the market will provide. We will therefore work in partnership with the DWP and the PPF to assess options as they emerge. Where it is in the wider interests of the pensions market, we will take forward the recommendations of the Public Bodies Review to work with the PPF in expediting schemes unlikely to be able to achieve low dependency or consolidation. Finally, we will support government in considering its consultation findings on establishing a public sector consolidator, administered by the PPF, to provide an alternative vehicle for DB schemes.

Driving DC value for savers and delivering suitable choice at retirement

We will evolve our approach to master trust supervision to check and challenge trustees' focus on value for money ahead of any legislation. At the same time, we will continue to work in partnership with the FCA and the DWP to develop a standardised assessment process for DC value for money, with data disclosures across three key elements including investment performance, cost and charges, and quality of services. Ahead of any new legislation, we will also encourage voluntary disclosures for trust-based schemes and develop rules for contract-based schemes working with the FCA. Ongoing engagement with industry is central to our work on value for money and environmental, social and governance (ESG) to ensure outcomes from this work deliver value for savers.

Recognising that all savers deserve good value, our priorities for 2024-25 will include ensuring compliance with existing regulations, in particular the value for members assessment requirements that cover DC and hybrid schemes with assets of less than £100 million.

We acknowledge that value whilst saving needs to translate into good options at retirement. We will engage with the market through roundtable discussions with a view to developing guidance on decumulation, encouraging new decumulation models that combine flexible and predictable retirement income streams, and supported pathways for savers.

As part of our decumulation framework we will consider how schemes can mitigate risks to savers – longevity, inflation, sequencing and investment – through their decumulation offers and we will address this issue in our guidance.

Ensuring good governance and administration

Our focus regarding trusteeship will initially promote good standards by working closely with some of the largest professional trustee companies and through our supervisory engagement with some of the largest most significant schemes. With professional trustee firms increasingly playing a significant role in the landscape, we will be able to influence progress and help ensure high standards across the industry.

We launched the new general code in January 2024, and it sets our expectations for pension scheme governance across all scheme types. We will be seeking to gain insight into how the general code has been adopted across the sector to inform our future strategic direction and prioritisation.

Regarding administration, our attention will be on improving systems and data quality ahead of the rollout of pensions dashboards. We will support schemes as they prepare for their new dashboard duties, by providing guidance and contacting schemes ahead of their duties to explain what action they need to take.

Administration will continue to be a focus in our scheme relationships. We will expand our one-to-one relationships with key administrators, expanding our ability to directly influence saver outcomes. We will also deliver a regulatory intervention looking at how schemes are meeting our expectations in respect of measuring and improving data, and act where trustees fail to meet our expectations.

We recognise the importance of new technology and will work with industry and regulatory partners to understand how technology is being used in pensions, the risks associated with this (including cyber risks) and how technology can best be harnessed for savers’ benefit.

TPR forms part of a wider system of institutions with responsibilities toward financial stability. We will support the Bank of England in its system-wide stress testing by improving pensions schemes information disclosure and support the development of a new lending tool allowing relevant schemes to access liquidity facilities during times of market stress.

Looking beyond 2024-25

As we progress beyond 2024-25, we will be increasingly shifting our focus from embedding the DB funding regime towards the delivery of the DC value for money framework; enhancing workplace pensions through high standards in administration and governance; and the promotion of innovation across the sector – most notably in tackling deferred small pots and decumulation solutions.

We will maintain high compliance with AE through efficient, targeted regulation, evolving the AE operation to maintain high levels of compliance and saver protection in the most efficient and effective way. This means ensuring that employers’ and advisers’ knowledge is maintained, reducing interventions among the lower-risk majority of employers, and targeting higher risk employers through early, data-led interventions.

We will work with the DWP and stakeholders to prepare for the changes to AE duties set out in the Pensions (Extension of AE) Act 2023, specifically the inclusion of younger workers under AE and the removal of the lower qualifying earnings threshold.

Establishing the DC value for money framework

We will support the DWP in developing the legislation underpinning the value for money framework. This needs to be complemented with a clear set of regulatory tools and guidance, that enable scheme level disclosure obligations, together with the powers to enforce compliance with any new regulatory requirements.

The implementation of a new DC value for money framework will take much of this strategic cycle to deliver. We will, however, seek to improve market transparency over value for money before full implementation of the framework through piloting it with the DC master trusts market on a voluntary basis from 2025-26.

Raising standards in trusteeship

We will continue to work with the industry to ensure trustees meet our expectations and that they have an effective system of governance, including appropriate levels of risk governance. This will include developing a framework for oversight of professional trustee firms, given their increasing role in the market.

We will also be improving our data coverage and insights into trusteeship. Through our one-to-one relationships and by widening our coverage, we will scope requirements for the development of a trustee register, as well as gain insight into how the diversity and inclusion on trustee boards is changing. Better data coverage will inform efficient, effective, and data-driven routes to improving trustee standards. Where necessary, this will also lead to targeted regulatory intervention programmes.

Supporting new technology in administration, managing risk and working to improve regulatory grip

As schemes connect to the pensions dashboards, we will monitor their compliance in providing data to savers in a timely and accurate manner, taking action where schemes fail to meet our expectations. We will work with the Money and Pensions Service, the DWP and the FCA to raise awareness of dashboards when launched so that their use benefits savers widely. We will also encourage industry to develop and adopt wider pensions technology where it is safe and delivers value to savers.

Technology will support increased saver engagement, but it also presents scammers with new opportunities to commit fraud, putting savers’ pensions at risk. As the lead for the Pension Scams Action Group, we will continue to work with partners, including those in law enforcement, to educate industry and savers on the threat of scams, prevent practices that harm savers’ outcomes, raise awareness of emerging threats, facilitate intelligence sharing and work with others to fight fraud through the prevention, disruption, and punishment of criminals.

We will continue to engage directly with administrators to ensure a robust understanding of the market and promote our messages to drive improvements in quality and higher standards. In the longer term, we will work with the DWP to explore policy options on building the case for the mandatory accreditation or authorisation of administrators, where this is in the best interests of maintaining high standards for savers.

Enabling deferred small pot consolidation

With millions more savers participating in pensions, movement between jobs is a key factor in the sharp rise in the number of small, deferred pots. The government is committed to developing solutions supporting deferred small pot consolidation.

We will work with government and industry to take forward the recently proposed default consolidator model. We will also work with industry to see where we can help advance voluntary solutions that provide more immediate improvements to savers. We are considering the broader issue of multiple pots, big or small, and exploring what we can include in our guidance alongside longer-term practical measures, including what opportunities lie within pensions dashboards.

Supporting DC retirement solutions and market innovation

The government supports the potential for schemes to offer decumulation products, proposing a new legal duty on schemes, while across collective DC (CDC) schemes, forthcoming legislation for multi-employer products will provide opportunities for innovation and more choice for savers.

We will continue to collaborate with the DWP in developing the regulatory framework for new CDC models, including ‘decumulation only’ CDCs, as well as any future legislative framework supporting decumulation more generally.

Our evolving organisation

Evolving our organisation design

One of our operational priorities is to be a proactive, digitally enabled, and well-informed regulator, addressing key risks in the market. To deliver effective regulation in a changing market, we are realigning our workforce within several core directorates.

This will mean that we will engage differently with the market, with three new regulatory directorates to protect, enhance, and innovate in savers’ interests.

- Regulatory Compliance – protecting pension savers’ interests through the effective and efficient delivery of regulatory compliance services, targeting schemes and employers.

- Market Oversight – enhancing the market through strategic engagement with schemes and others who influence delivery of enhanced pension savers’ outcomes with a strong focus on delivering value for money and trusteeship.

- Strategy, Policy, and Analysis – using insights from our regulatory approach and elsewhere to evolve the regulatory framework and support market innovation in savers’ interests.

These will be supported and enabled by Operations, Digital, Data and Technology, and People teams. Within our new structure we will meet the dynamic needs of the pensions market by streamlining our approach, improving collaboration, quickening our pace, and harnessing new skills.

Developing our people and culture

Transparency and accountability in leadership

To ensure transparency and rigour in fulfilling our duties, we will formalise the frameworks for allocating ownership of important decisions and risks. Our efforts will be centred on the effective implementation of the Senior Managers Regime within TPR, which involves detailing the responsibilities and duties of senior leaders, defining conduct standards, and identifying and rectifying any gaps in standards or capabilities.

To enhance clarity, transparency, and accountability, along with a stronger focus on outcomes, we have identified, and committed our senior leaders to strategically aligned and refreshed key performance indicators (KPIs). This will serve as a foundation for progressively cascading aligned objectives throughout TPR.

Equality, diversity and inclusion (EDI)

Our annual EDI action plan will complement the People and Culture Transformation Programme, embedding diversity and inclusion into the way we operate as an organisation and ensuring high standards of EDI in our policy delivery. We continue to champion EDI within the pensions industry and work with partners to identify and share best practice, creating a culture that values diversity and is inclusive by design.

Investing in people

Becoming a regulator fit for the future requires the acquisition of new knowledge and skills. Investing in our people is central to this acquisition. To this end, we will identify the specific skills and talents necessary for the initial stages of our transition. Following this, we will conduct a pilot to trial strategic workforce planning and examine how we can best develop our capability needs in line with our future vision. This will also be supported by a review of our pay and bonus structures, ensuring that our reward system is aligned to our ambition.

Multi-disciplinary teams

Recognising the rapidly evolving pensions market, we understand the necessity to leverage our expertise and know-how to its fullest. This calls for working in ways that maximise efficiency, foster quick formation and high performance of teams, and utilise innovative and cutting-edge data and insights. Moreover, it necessitates assertiveness in our actions. To achieve this, we are piloting a new approach to multi-disciplinary teams, initially focusing on the master trusts and value for money objectives. This will allow us to learn and improve how we collaborate and deliver enhanced outcomes across TPR.

Outcome focused delivery of data-led, digitally enabled services

The pensions industry is undergoing a technological revolution, with technology integration in new digital platforms, data analytics and artificial intelligence (AI) reshaping how the market operates. We are making significant investment in our capability to become a data-led, digitally enabled regulator and there are three priorities for the upcoming year.

- Enabling the new DB funding regime through developing systems that support improvements in scheme data submissions, analysis, and case management.

- Future-proofing our information systems architecture and infrastructure by creating common platforms supporting the implementation of the DC value for money framework and allowing for longer-term ambitions, such as enhancement of regulatory oversight across the trustee landscape.

- Increasing operational effectiveness and investing in our people through modernising our data estate and updating and enhancing our operational systems.

Ensuring environmental sustainability

Having set our corporate net zero target for 2030 as part of our 2021 Climate Change Strategy, we have been working to better understand our operational emissions and how to reduce them. This work has culminated in our net zero plan which sets out the emissions in scope for our 2030 target. This includes natural gas, electricity, business travel, waste, and water. It also established our baseline year of 2017-18, and the interventions required to deliver a more than 90% reduction against the emissions in scope by 2030.

As we progress with the interventions required for delivery of net zero, we will seek to establish more ways to ensure our operational environmental impacts are minimised. This includes not only mitigation of environmental impacts, but adaptation to the effects of climate change we are already seeing. To this end, we will be publishing our Adaptation Strategy in 2024.

Delivering value through greater efficiency

The Government Efficiency Framework was introduced in July 2023 to report efficiencies and ensure an appropriate level of government oversight to track delivery and drive improvement. As we evolve through our new organisational design, we will develop our ways of working and continually improve the effectiveness of what we do. We will evaluate our work to identify and report on efficiencies, measuring our regulatory and operational effectiveness via corporate measures as identified in Managing risk and performance below.

Our funding is derived from two main sources: a grant-in-aid from the DWP to fund our Pensions Act 2004 duties (levy-funded activities), and a separate grant-in-aid from general taxation relating to the AE duties arising from Pensions Act 2008 (AE-funded activities).

The overall spend for 2024-25 was set as part of a three-year funding settlement in 2021 (known as SR21). The financial year 2024-25 is the final year of this spending review period. As part of the SR21, we committed to achieving efficiency savings of 5% for levy and 23% for AE by the 2024-25 financial year. The budget for 2024-25 incorporates planned efficiency savings of £14.5 million (£3.8 million for levy and £10.7 million for AE) against the original baseline.

The budget for 2024-25 is expected to be £112.1 million (excluding salary related adjustments) which represents a £10 million reduction from the previous financial year. The next spending review will take place later in 2024 and we will work with the DWP to prepare an appropriate submission taking into account the level of expectation on TPR and our regulatory commitments.

Managing risk and performance

Risk appetite statement

Our risk appetite statement (RAS) demonstrates how we balance risk and reward in pursuit of our statutory objectives. The RAS enables the Board to provide an approved steer on how the organisation should manage different types of risk based on resource, strategy and current risk landscape. In setting and applying the RAS, we take account of our role and obligations as a public body, including in respect of the Regulators’ Code and the principles of good regulation. The RAS is owned, set and reviewed by the Board on an annual basis.

The RAS is designed to be used as a decision-making tool, to enable decisions to be made in line with the Board’s agreed appetite in specific areas. It is a practical tool – where a risk or an issue is clearly outside our stated appetite, we will flag this (risks out of our stated appetite are routinely reported to the Board and Audit and Risk Assurance Committee) and consider the actions needed to bring the risk back within appetite, consciously tolerate it being outside of appetite or consider changing our appetite.

The RAS is also the first step towards identifying, at a high level, whether risks we are already managing under a certain category are being treated in line with the appetite statement.

The application of the RAS is not designed to cover every eventuality, but to support decision makers when exercising their discretion. It should not be seen as a restriction or restraint on our operational activity. TPR Board accepts there will be exceptions where we have consciously decided to operate outside of our chosen appetite, particularly where different appetites intersect and overlap. The key requirement is that we are able to document and evidence that the RAS has been consulted and considered.

Our risk appetite classifications are as agreed and set out by the Government Finance Function and guidance in the Orange Book.

| Averse |

Avoidance of risk and uncertainty in achievement of key deliverables . Initiative is a key objective. Activities undertaken will only be those considered to carry virtually no inherent risk. |

|---|---|

| Minimalist |

Preference for very safe business delivery options that have a low degree of inherent risk. Potential for benefit/return not a key driver. Activities will only be undertaken where they have a low degree of inherent risk. |

| Cautious |

Preference for safe options that have low degree of inherent risk. Limited potential for benefit. Willing to tolerate a degree of risk in selecting which activities to undertake to achieve key deliverables or initiatives, where we have identified scope to achieve significant benefit and/or realise an opportunity. Activities undertaken may carry a high degree of inherent risk that is deemed controllable to a large extent. |

| Open |

Willing to consider all options and choose one most likely to result in successful delivery. Providing an acceptable level of benefit. Seek to achieve a balance between a high likelihood of successful delivery and a high degree of benefit and value for money. Activities themselves may potentially carry, or contribute to, a high degree of residual risk. |

Overarching statement

As a risk-based regulator, we are not averse to taking risks. Our approach is based on professional judgement and the individual circumstances of each situation, potential risk, and an assessment of its likelihood and impact.

We will not always seek to intervene in all situations. We will prioritise in terms of level of risk, cost and potential benefits in a consistent, methodical and transparent way. Choosing the most appropriate course of operational and/or regulatory action and approach and maintaining a minimalist appetite to risks that may threaten our ability to deliver our strategy.

External/regulatory risk

The whole pensions system is undergoing reform, involving new legal frameworks, the creation of new delivery models and a host of new entities for us to engage with and regulate.

We are averse to risks of significant harm to savers created by those who we regulate failing to meet the standards required to protect savers, as explained in our codes of practice and guidance.

However, we recognise that there are significant advantages for savers where the market is able to try new things. We therefore have an open appetite to market participants taking well managed risks to enhance and improve the pensions system. We will support innovation where it is in the interests of savers.

Reputation

We rely on our reputation in order to influence and secure the engagement of the regulated community, industry participants and stakeholders. The support of these parties is essential to protecting savers and so we hold a strong commitment to being seen as a proportionate and respected authority within the pensions arena.

However, as a risk-based regulator with finite resources we are required to make difficult prioritisation decisions and we put the interests of savers ahead of our own reputation. We are therefore prepared to take a stance which may result in negative publicity arising from external bodies or media where we believe it is necessary for the achievement of our stated strategic aims and retain an overall cautious risk appetite regarding our reputation.

Legal

In order to be an effective regulator, it is very important that we have sufficient and appropriate powers. Where we are working with untested legislation, we are willing to adopt an open risk appetite to achieve our statutory objectives and to determine the extent of our powers and our jurisdiction.

As a public body we accept that we are likely to be subject to judicial review. Whilst we welcome this form of scrutiny, we are averse to behaving in a way which makes it likely that such a review would be successful. We therefore avoid acting in a way that could be seen as illegal, procedurally unfair or irrational (as those are the main grounds for a judicial review).

Operational

Whilst we are minimalist around having inadequate business continuity and disaster recovery plans, in order to operate with sufficient speed, efficiency and effectiveness we maintain a cautious appetite regarding the operation and governance of our functions, with proportionate controls to maintaining our processes and both managing our day-to-day operations and change.

Technology

Recognising that our core purpose is to regulate pensions and that technology is an enabler of this, we have a cautious risk appetite regarding risks to the stability and availability of our IT systems. However with regard to risk arising from having poorly designed and managed systems we have a minimalist appetite and particularly where these expose us to cyber risk.

Information and data

We are heavily reliant upon information and data to be able to operate as an effective risk-based regulator. Whilst it is important that we protect our data it is even more important that we’re able to access and make use of it in pursuit of our regulatory functions.

We therefore maintain a cautious risk appetite relating to data identification, storage and handling. The accidental or deliberate wrongful disclosure of sensitive or restricted information has the potential to erode trust, damage our reputation and ultimately prevent us from being able to function. We acknowledge that it would be disproportionate to eliminate all risk in this area and still be able to perform our functions and as such we have a minimalist appetite for such risks.

Financial and fraud

As a public body funded by the levy payers and taxpayers, we have a minimalist appetite to financial risk and as such we maintain strong controls on spending and investment.

We are averse to the risks of internal fraud and fraudulent behaviour and will maintain appropriately robust controls and sanctions to maximise prevention, detection, and deterrence of this type of behaviour.

People

We expect high standards of conduct from our people and are averse to risks arising from inappropriate personal conduct of staff or non-adherence to TPR’s values and polices.

We recognise that people are our greatest asset and as such we aim to have a supportive and consistent culture aligned to our values.

We maintain a minimalist risk appetite with regards to anything that threatens this or the wellbeing of our people.

We strive to maintain the capabilities required to operate effectively acknowledging that we may have to accept an element of risk in this area and as such have a minimalist appetite.

Performance measurement

Our performance measurement framework provides a clear line of sight between our strategic ambitions and how we assess our work and its impact.

This year, we have reviewed our existing framework to better reflect our evolving priorities and developed a streamlined set of performance measures. This is why we are shifting from two sets of indicators – key outcome indicators (KOIs), which are long-term measures aimed to track our progress towards the saver outcomes over time; and KPIs, which are annual measures of performance against prioritised activities – towards a combined KPI/KOI set of outcomes focused measures (priority outcomes).

We have aligned our priority outcomes to our vision for the market, namely: fewer, well-run schemes, delivering good outcomes – from joining a pension through retirement.

Our priority outcome metrics are split between measures covering our ‘regulatory outcomes’ and measures covering how we will work to deliver on our objectives (strategic enablers).

Our priority outcome measures are below.

Priority outcomes (regulatory) for 2024-25

Priority regulatory outcomes 1: Fewer schemes, delivering good outcome

We expect the pensions scheme to offer value to savers.

Priority outcome 1.1 – DC schemes offer value

- DC schemes are compliant with value for members assessment requirements, or wind-up or transfer benefits to different arrangements where it is in the savers’ interest.

Priority outcome 1.2 – Growth in the consolidation market

- Growth in the consolidation market, measured by growth in proportion of savers in CDCs, DC master trusts and DB models used for consolidation.

Priority regulatory outcomes 2: Schemes are well run

We expect the capabilities of those running schemes to improve over time and for this to be reflected in improvements in governance and an increased emphasis on improving the quality of scheme administration.

Priority outcome 2.1 – Improved scheme governance

- Baseline of new ‘governance quality’ measures reflecting key elements the general code, based on composite measures that will be developed and deployed in DB and DC surveys.

Priority outcome 2.2 – Administrative preparedness for pensions dashboards

- Schemes are ready for the pensions dashboard in a timely manner (timely is framed in terms of the date in guidance pertaining to that scheme).

Priority outcome 2.3 – Improved ESG recognition

- Baseline percentage of TCFD-aligned climate reports that demonstrate understanding of issues related to climate scenario analysis.

Priority outcome 2.4 – Financial stability

- No material resilience headroom breaches across all types of LDI mandates.

- We will also seek evidence of robust processes around collateral management.

Priority regulatory outcomes 3: Good outcomes – joining a scheme

We will ensure that employers’ compliance with their automatic enrolment duties remain high.

Priority outcome 3.1 – Compliance with AE duties

- Percentage of employers ultimately compliant with their automatic enrolment/re-enrolment duties remains above target. The target is 90% of employers having arrangements with a qualifying scheme.

Priority outcome 3.2 – Maintaining contributions

- Percentage of employers making timely and accurate pensions contributions remains above existing target. The target is 94% of employers making contributions before they become late by three months or more.

Priority regulatory outcomes 4: Good outcomes – at retirement

We will work to encourage the development of safe pathways for savers in their retirement and encourage the industry to protect savers from scams.

Priority outcome 4.1 – DB savers get their pensions

- DB schemes progress towards low dependency funding. This is measured by aggregate ‘low dependency’ funding ratio as at 31 March 2025.

Priority outcome 4.2 – Availability of decumulation pathways

- Baseline percentage of scheme members approaching retirement, who are offered by their scheme two or more decumulation products to access their pension pots other than, full and partial cash withdrawal.

Priority outcome 4.3 – Protection from pension scams

- Percentage sign up to pension scams pledge and ‘self-certification’.

Priority outcomes (enabling) for 2024-25

Priority enabling outcomes 1: Developing our people and culture

We will promote an engaged, skilled and motivated workforce who can bring their whole selves to work and be treated equally, fairly and professionally.

Priority outcome 1.1 – Workforce stability

- We will maintain a stable and healthy workforce. We ensure a stable workforce as measured by the workforce ‘stability index’ (number of workers with one year's service or more, divided by number of workers with less than 12 months' service, multiplied by 100).

Priority outcome 1.2 – Employee satisfaction

- We will work towards high levels of employee satisfaction. New indicators of employee satisfaction will be developed and delivered through more frequent employee ‘pulse’ surveys.

Priority outcome 1.3 – Equality, diversity and inclusion

- We will promote an equal, diverse and inclusive workspace.

- We will monitor our progress in supporting EDI through recruitment, pay and senior management representation and baselining our progress against key EDI measures through reporting and explaining variances where they occur.

Priority enabling outcomes 2: A data-led, digital-enabler underpinned by modern technology

Harnessing the power of digital, data and technology to drive transformation, efficiency and regulatory excellence in the best interests of savers.

Priority outcome 2.1 – Strengthen our foundations

- We will strengthen our foundations in DDaT by building on our talent, capability and capacity. To this end, we will have successfully recruited across 30 key DDaT roles.

Priority outcome 2.2 – Deliver Submit

- We plan to enable adoption of the new DB Funding Code by releasing new guidance on processes this year. This includes the collection of new DB data as informed by our user centred approach to digital delivery.

Priority outcome 2.3 – Improve system hygiene

- We will invest to ensure that our core infrastructure remains modern and robust. This will mean delivering across multiple systems hygiene projects, including Windows 11 upgrade.

Priority outcome 2.4 – Design and deliver new standards

- We will develop common design, technology and data rules, and building blocks. This will ensure strong integration, efficiency and improved security. It will be supported by new standards that will be designed and defined during 2024-25.

Priority enabling outcomes 3: Ensuring environmental sustainability

We will reduce our environmental impact and progress towards the delivery of our net zero carbon emissions targets.

Priority outcome 3.1 – Greening Government Commitment (GGC) targets

- We will continue to deliver on the GGC targets.

Priority outcome 3.2 – Net zero by 2030

- We will deliver an annual reduction in the emissions in scope for our 2030 net zero target.

Priority enabling outcomes 4: Ensuring robust financial controls, efficiency and effectiveness

We will ensure robust financial controls and seek continual improvements in our efficiency and effectiveness.

Priority outcome 4.1 – Ensuring robust financial controls

- Our financial procedures and controls will ensure that TPR’s budgets and funding stay within tolerances agreed with DWP.

Priority outcome 4.2 – Improving our efficiency

- We will embed a new organisational design and develop new ways of working through a series of targeted work packages aimed at improving the efficiency and effectiveness of what we do. Efficiencies will be evidenced using the recommendations of the Government Efficiency Framework.

Priority outcome 4.3 – Evidencing our effectiveness

- We will build evaluation into our assessments of performance across our regulatory priorities through baseline research and targeted assessments of existing activities.