Annual report on defined benefit (DB) valuations and recovery plans of DB and hybrid pension schemes.

Published: 27 July 2021

Overview

This is the 2021 update to The Pensions Regulator’s (TPR) annual funding statistics for UK defined benefit (DB) and hybrid schemes. The underlying data is sourced from valuations and recovery plans submitted to TPR for schemes with deficit positions, and from annual scheme returns for schemes with surplus positions. The tables in the annex are prepared in accordance with the UK Code of Practice for Official Statistics.

The update is based on tranche 14 schemes with effective valuation dates falling from 22 September 2018 to 21 September 2019 inclusive. These valuations fall within the fifth triennial cycle of scheme funding with due dates for receipt falling within the period December 2019 to December 2020.

The report shows funding trends in the context of market conditions, assumptions and scheme characteristics that impact on valuations. It also describes reported arrangements for recovery plans, employer contributions and contingent security.

The report is comprised of several sections. Specifically, section 2 summarises the key figures in the current tranche. Section 3 discusses market conditions associated with the current tranche. Funding levels are summarised in section 4 and funding strategies are covered in section 5. Valuation assumptions are reported in section 6. Data summaries (tables) contained in the annex provide more detail on the high-level trends presented in this report. Note that tranche 14 belongs in the cohort with tranches 2/5/8/11, meaning comparisons with other years will generally be limited to these tranches.

Tranche 14 summary

By the end of January 2021, TPR had received over 1,660 valuations (annex table 1.1) with an effective valuation date covered by tranche 14. Almost one third (31%; annex table 1.2a) of schemes reported a surplus on the technical provisions (TPs) funding basis. Of schemes submitting these valuations, 74.8% had previously submitted valuations in tranches 11, 8, 5 and 2.

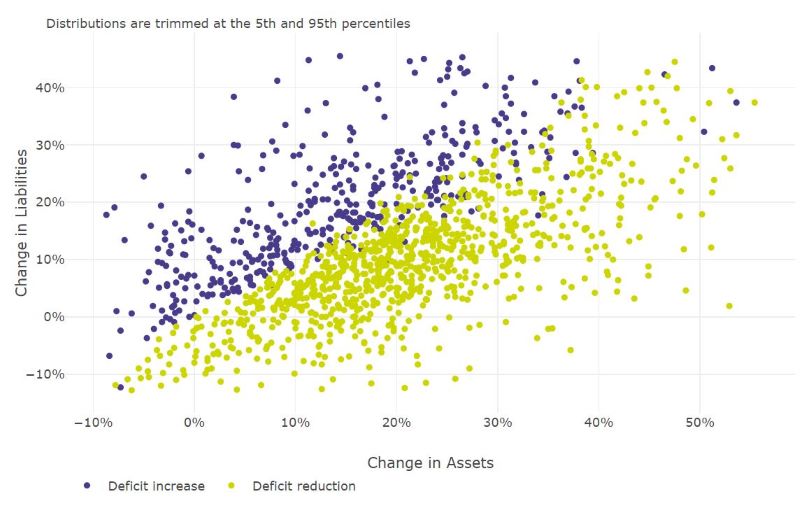

Assets, liabilities and deficits/surpluses in this report are defined on a TP basis, unless otherwise stated. See the glossary section in the annex for further information. The growth in assets exceeded the growth in liabilities between tranche 11 and 14 valuation dates for a majority of schemes, resulting in a relatively increased average[1] funding ratio on a TPs basis (annex table 2.1a). Compared to tranche 11, average annual deficit reduction contributions (DRCs) as a proportion of TPs for tranche 14 are relatively unchanged, at the median in nominal terms (annex table 3.4). The relative increase in average annual DRCs between tranches 11 and 14 is 8% at the median, while the median extension to the recovery plan end date is one year.

Figure 1, below, illustrates the distribution of changes in deficits measured on a TPs basis for tranche 14 schemes that previously submitted tranche 11 valuations. At the median, scheme assets grew by 18%, whereas TPs grew by 12%. The median relative change in deficits for all schemes is -31%, with around 67% of all schemes experiencing a reduction in deficit over the inter-valuation period[2].

Figure 1: Distribution of the change in deficits from tranche 11 to tranche 14 (all schemes in both tranches)

Figure 1: Distribution of the change in deficits

Source(s): TPR

2.1 Key figures at a glance

- 31% of schemes in surplus

- Average ratio of assets to TPs for schemes in deficit and surplus: 91.4% (median: 92.6%)

- Average ratio of assets to TPs for schemes in surplus: 109.1% (median: 105.5%)

- Average ratio of assets to TPs for schemes in deficit: 83.8% (median: 86.9%)

- Average RP length for schemes in deficit: 5.9 years (median: 5 years)

- Average nominal single effective discount rate (SEDR) for tranche 14 schemes in deficit and surplus: 2.43% (median: 2.44%) with 50% of assumptions falling on or between 2.05% and 2.8%. SEDR is defined in the Methodology section of the annex

- Average real SEDR for schemes in deficit and surplus -1.04% (median: -1.02%); with 50% of assumptions falling on or between -1.35% and -0.65%

- Median life expectancies (in years) of future pensioners currently aged 45 for schemes in deficit and surplus - male: 88.7; female: 90.9

Market conditions

Equity markets performed positively during the inter-valuation period (tranche 11 to tranche 14 valuations). Relative to 1 April 2019 (the effective date of many tranche 14 valuations being Sunday 31 March 2019), the FTSE All-Share Index realised a three-year total return of 32%[3]

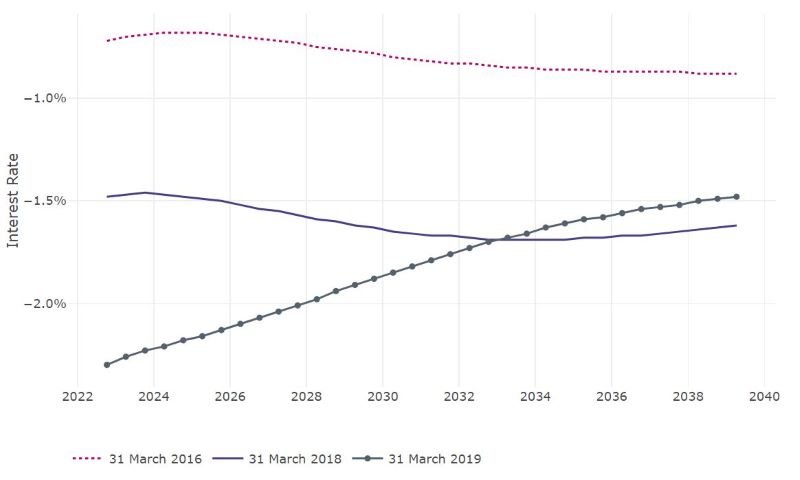

Throughout much of the period between March 2016 and March 2019, government gilt yields fluctuated reflecting market volatility and uncertainties, first around the Brexit referendum and later over the period of transition.

The real 20-year spot rate of interest, already in the region of negative yields during the previous valuation period, remained negative (-2.5%) towards the end of the tranche 14 valuation period.

Figure 2, below, shows market expectations for real interest rates as estimated by the Bank of England in the inter-valuation periods.

Forward interest rates at the end of March 2019 potentially indicate market expectations for rising yet negative rates over the time horizon.

Figure 2: UK instantaneous real forward curves

Figure 2: UK instantaneous real forward curves, for 31 March 2016, 2018 and 2019

Source(s): Bank of England

Funding levels

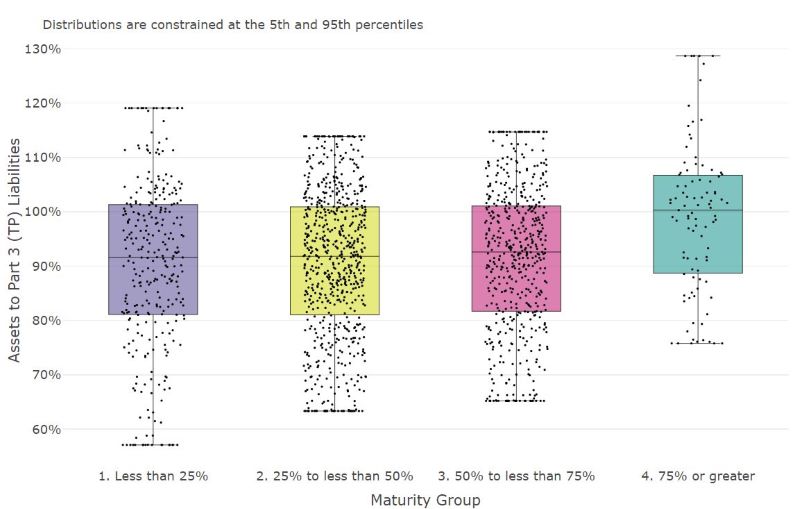

Figure 3, below, shows the distribution of the ratio of assets to TP liabilities for tranche 14 schemes according to scheme maturity group (four categories describing a scheme’s ratio of pensioner TPs to total TPs).

The median level of TP funding generally increases across each of the maturity groups, from 92% among schemes with maturity levels less than 25%, to 100% for schemes with maturity levels of 75% or greater.

Figure 3: Assets to Part 3 (TP) Liabilities (per cent) by maturity (tranche 14, all schemes)

Figure 3: Ratio of assets to Part 3 (TP) Liabilities (per cent) by maturity group

Source(s): TPR

Tranche 14 schemes saw improved asset positions compared to tranche 11 schemes in the previous cycle. This which may have been due to the combined impact of:

- sponsor contributions (regular and remedial), and

- positive (overall) gains on investments in the three years to valuation

Liabilities have also grown due, in part, to lower investment return assumptions relative to those assumed in the previous valuation - which in turn may have been driven by revised (lower) expectations for long-dated bond yields relative to tranche 11 valuations. In general, schemes with hedged positions in respect of interest rate risk will have fared better overall.

- Average ratio of assets to TPs for schemes in deficit and surplus (annex table 2.1a): 91.4% (median: 92.6%).

- Average ratio of assets to TPs for schemes in surplus (annex table 2.3a): 109.1% (median: 105.5%).

- Average ratio of assets to TPs for schemes in deficit (annex table 2.3a): 83.8% (median: 86.9%).

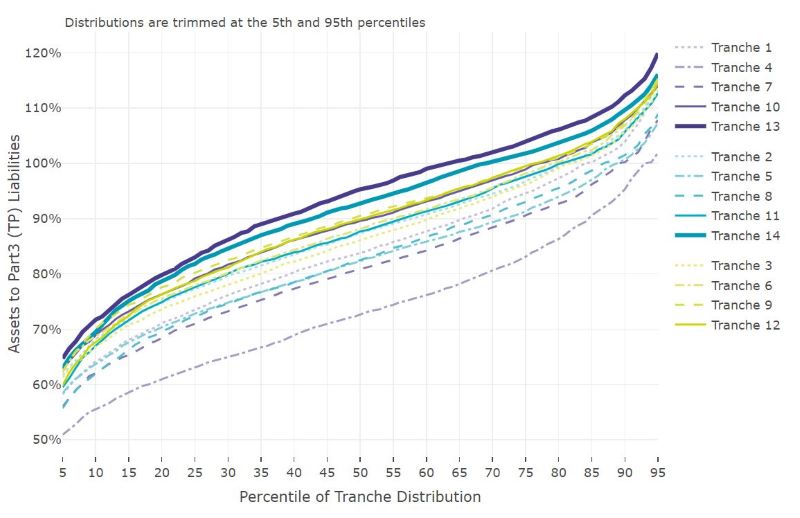

Figure 4, below, illustrates the distribution of the ratio of assets to TPs for tranches 2, 5, 8, 11 and 14. Compared to all other tranches, funding levels in tranche 14 are higher across all percentiles of the distribution. At the median, the TP funding ratio for tranche 14 is 93%, compared with 88% among the tranche 11 cohort[4].

Figure 4: Ratio of assets to Part 3 (TP) Liabilities (per cent) (all schemes, all tranches)

Figure 4: Ratio of assets to Part 3 (TP) Liabilities (per cent)

Source(s): TPR

For schemes submitting valuations in respect of both tranche 11 and tranche 14, the median increase in asset values between valuations is 18%, and the median increase is 12% for TPs. The average ratio of assets to TPs for tranche 14 is 91.4% (96% weighted[5]), a 4.4 percentage point increase on average over tranche 11. The average ratio is generally higher for schemes:

- that report liabilities in respect of active memberships

- with stronger covenants (deficit schemes only)

- without a contingent asset

- with shorter recovery plans

- which are more mature

See tables 2.1 and 2.3 in the annex for further detail on funding ratios

For schemes in surplus only, the average ratio of assets to TPs is 109.1% (106.6% weighted).

Relatively higher funding among schemes reporting TPs in respect of active members could reflect that less well-funded schemes are more likely to close to future accruals.

Funding strategies

Recovery plans

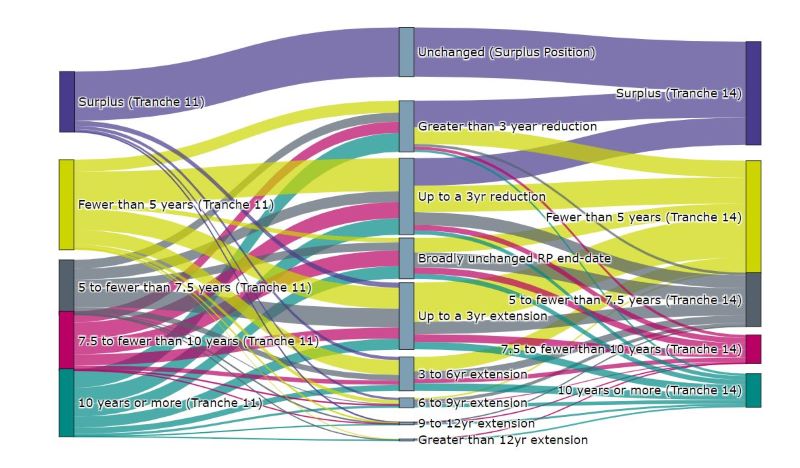

Approximately one in seven (14%) of schemes with valuations in both tranche 11 and tranche 14, reported a surplus of assets over liabilities in both tranches. Around one in six schemes (16%) moved into a position of surplus, with around one in thirty (3%) moving into deficit, from a surplus position in tranche 11.

Approximately two thirds (66%) of schemes with valuations in both tranche 11 and tranche 14 reported a shortfall of assets against liabilities in both tranches. For almost eight out of ten (79%) of these schemes, a reduction in the size of the deficit between tranches (amongst other factors), is associated with a shortened recovery plan period in tranche 14, relative to that agreed under the tranche 11 valuation.

Given the (broadly) three year inter-valuation period itself however, a reduction in recovery plan length of less than three years between tranches, still represents an extension to the date at which the scheme is anticipated to be fully funded. Figure 5, below, shows the distribution of changes to recovery plan end dates for tranche 14 schemes that had previously submitted tranche 11 valuations. Just under two thirds of schemes (65%) - including those which remain in surplus - have brought forward their recovery plan end dates or have left them broadly unchanged. One in five (20%) schemes have extended their recovery plan end-date by up to three years (representing a recovery plan of a similar length in tranche 14 relative to that agreed in tranche 11), with around one in six (15%) extending their recovery plan end-date by more than three years.

Figure 5: Distribution of changes to recovery plan end dates, by tranche 11 and tranche 14 recovery plan length groups (schemes in both tranches 11 and 14)

Figure 5: Distribution of changes to recovery plan end dates by recovery plan length groups

Source(s): TPR

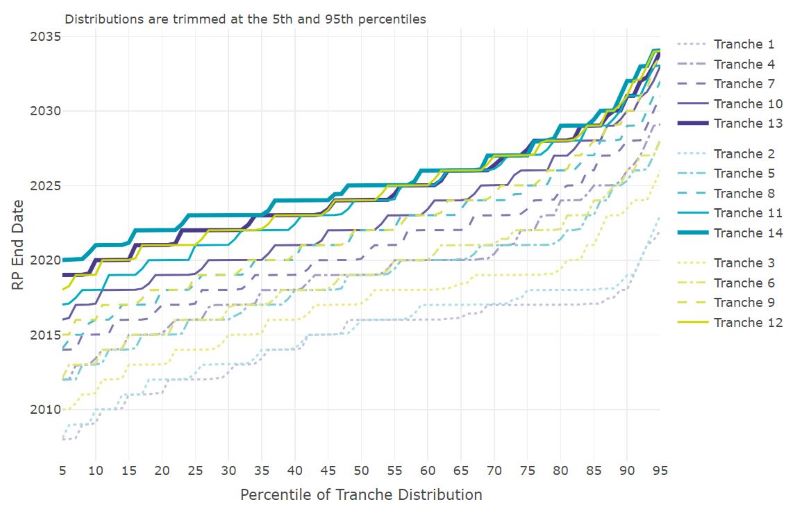

Figure 6, below, highlights the distribution of recovery plan end dates by tranche (tranches other than the 2/5/8/11/14.

Although the RP end-dates for recovery plans has increased in tranche 14 across the distribution, there has been a narrowing in the upper half of the distribution, ie 55th percentile and above.

Compared with tranche 11, tranche 14 end dates have increased by one year at the median, 0 years at the 75th percentile and one year at the 95th percentile.

Figure 6: Distribution of recovery plan end-dates (schemes in deficit, all tranches)

Figure 6: Distribution of recovery plan end-dates

Source(s): TPR

In respect of their first valuations under scheme specific funding, schemes in tranche 2 had a median recovery plan end date falling in 2016. Under the fifth cycle of funding, broadly the same set of schemes have a median recovery plan end date falling in 2025 (see: tabular output for figure 6).

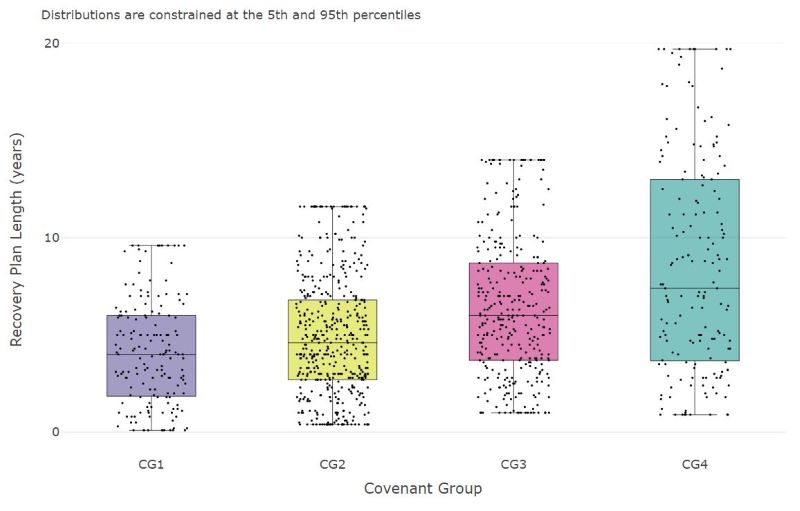

The mean and median recovery plan lengths for tranche 14 schemes in deficit are 5.9 and 5 years respectively. For tranche 11 these figures were 7.5 and 7 years respectively (annex tables 3.3 and 3.1).

Longer recovery plans tend to be associated with schemes:

- with weaker covenant support[6]

- with lower levels of funding on a TP basis

- with at least one contingent asset (annex table 3.3)

- with holding higher proportions of return seeking assets

See tables 3.1, 3.2 and 3.3 in the annex for more detail on recovery plan length

Figure 7, below, shows the distribution of recovery plan lengths for tranche 14 schemes by covenant group[7]. Three quarters of schemes in covenant group 1 (strong) have recovery plans of up to six years, while the same proportion of schemes in covenant group 4 (weak) have recovery plans of up to 13 years.

Figure 7: Distribution of recovery plan length by covenant group (tranche 14 schemes in deficit)

Figure 7: Distribution of recovery plan length by covenant group

Source(s): TPR

The table, below, shows the median extension to recovery plan end date extension according to covenant group migration. The largest increase is 2.5 years for schemes migrating from covenant group 3 to covenant group 4 over the inter-valuation period. Generally, the smallest transitions are associated with schemes which stayed within the same covenant group.

Table: Median recovery plan end date extension by covenant group migration (tranche 14 schemes in deficit only)

| Covenant Group (Tranche 14) | ||||

|---|---|---|---|---|

| Covenant Group (Tranche 11) | 1 | 2 | 3 | 4 |

| 1 | 0.0 | 0.3 | ||

| 2 | 0.3 | 0.0 | 1.0 | 0.3 |

| 3 | 0.5 | 0.0 | 2.5 | |

| 4 | 0.0 | 0.1 | 0.2 | |

Table: Median recovery plan end date extension by covenant group migration

Source(s): TPR

Contributions

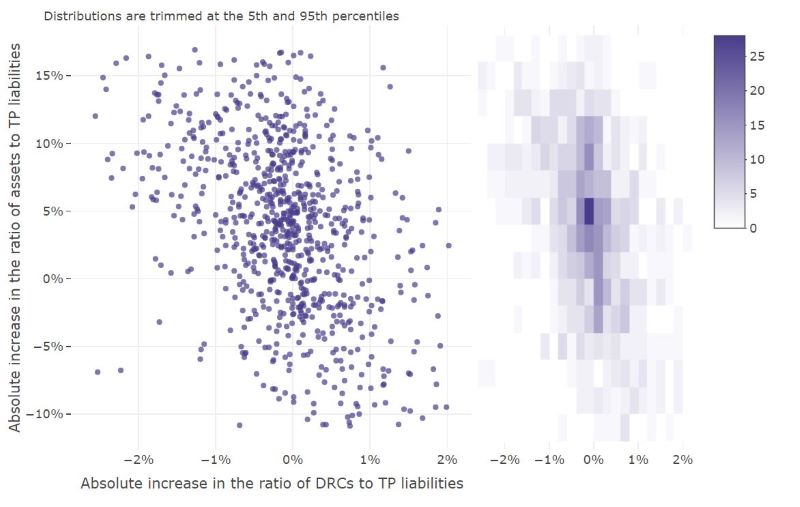

As a proportion of liabilities calculated on a TPs basis, average annual DRCs for tranche 14 schemes are unchanged at 2.3%, relative to tranche 11.

This is influenced by increases in liabilities calculated on a TPs basis, as well as changes in nominal DRCs. The median increase in TPs is 12% and the corresponding relative increase in average annual DRCs is 7%. A higher level of DRCs as a percentage of liabilities on a TPs basis is associated with:

- shorter recovery plans

- smaller schemes (by both TPs and members)

- lower maturity

- schemes with a lower ratio of assets to TPs

Figure 8, below, shows the extent to which the percentage point increase in average annual DRCs as a proportion of TPs varies by the percentage point increase in TPs funding between tranche 11 and tranche 14 (schemes in deficit).

Figure 8: Absolute percentage increase in DRCs as a proportion of TP liabilities vs. Absolute percentage increase in the ratio of assets to TPs (schemes in deficit only; tranche 11 to 14)

Figure 8: Absolute percentage increase in DRCs as a proportion of TP liabilities versus Absolute percentage increase in the ratio of assets to TPs

Source(s): TPR

Asset allocation

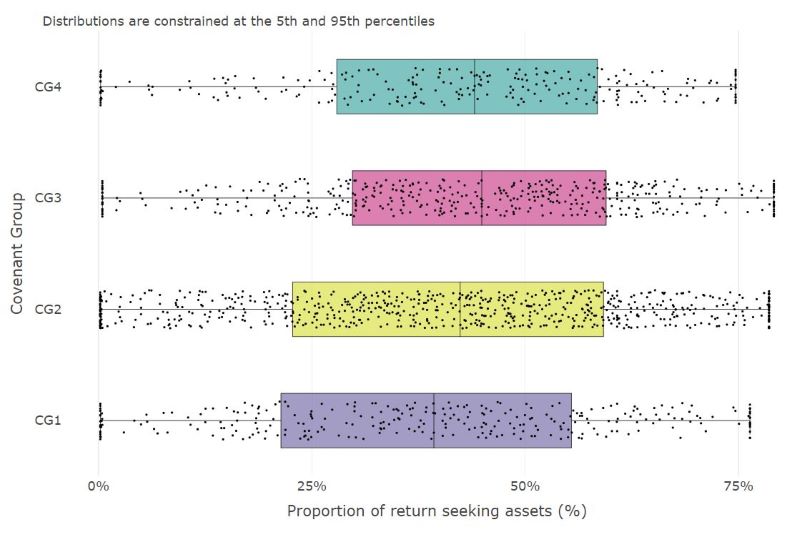

The majority of tranche 14 schemes have less than 40% of assets invested in return-seeking[8] asset classes, while fewer than a fifth of schemes have more than 60% allocated to return-seeking asset classes.(Annex Table 1.2a)

Figure 9a, below, shows the distribution of return-seeking assets by covenant group. The median allocation to return-seeking assets is 39% for covenant group 1 schemes, compared to 44% for covenant group 4 schemes. Generally, we observe an increased allocation to return-seeking assets with declining covenant strength, although there are a number of exceptions to this trend.

Figure 9a: Distribution of return-seeking assets by covenant group (tranche 14 schemes in deficit)

Figure 9a: Distribution of return-seeking assets by covenant group

Source(s): TPR

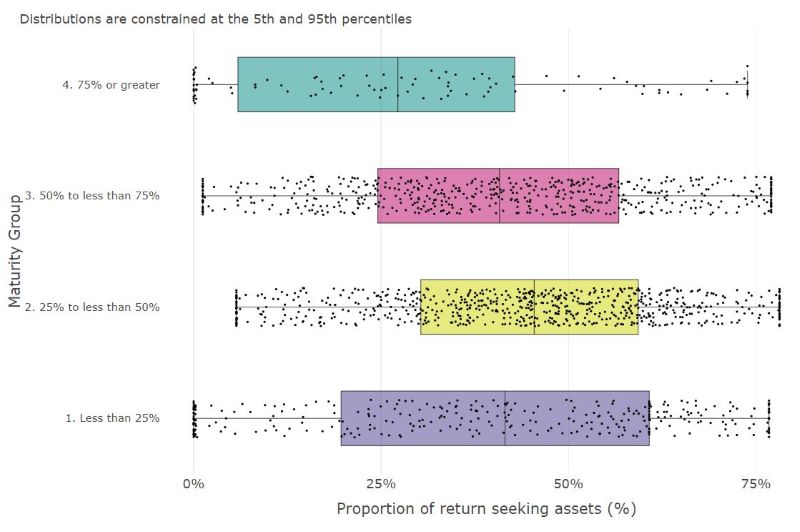

Figure 9b, below, shows the distribution of return-seeking assets by maturity group (as measured by the ratio of pensioner liabilities to total liabilities). The median allocation to return-seeking assets is 45% for schemes with 25% to less than 50% maturity, compared to 27% for schemes with greater than 75% maturity. Generally we observe a decreased allocation to return-seeking in the most mature group, compared to the others.

Figure 9b: Distribution of return-seeking assets by scheme maturity group (tranche 14 schemes in deficit)

Figure 9b: Distribution of return-seeking assets by scheme maturity group

Source(s): TPR

Contingent security

Fewer than a fifth (16.1%) of tranche 14 schemes have additional security in the form of one or more contingent assets, which typically, but not always, take the form of guarantees from a sponsor’s parent or associated group entity.

Around one in twenty (5.9%) schemes have contingent assets that are formally recognised by the PPF in the calculation of the PPF risk-based levy. Approximately one in ten schemes (10.5%) have contingent assets that are not recognised by the PPF but are reported as additional security in support of funding.

The presence of contingent assets is associated with larger schemes, by both members and liabilities.

See tables 2.6 and 2.7 in the annex for more information on contingent security

Valuation assumptions

Discount rates

Market experience and changing expectations over the inter-valuation period may be reflected in discount rates to varying degrees, depending on investment strategy and/or valuation approach. The statistics show an association between the TP’s discount rate and a scheme’s investment strategy. The investment strategy of a scheme is approximated here by the scheme’s allocation to return-seeking assets. It may also consider the ability of the employer to underwrite downside risk.

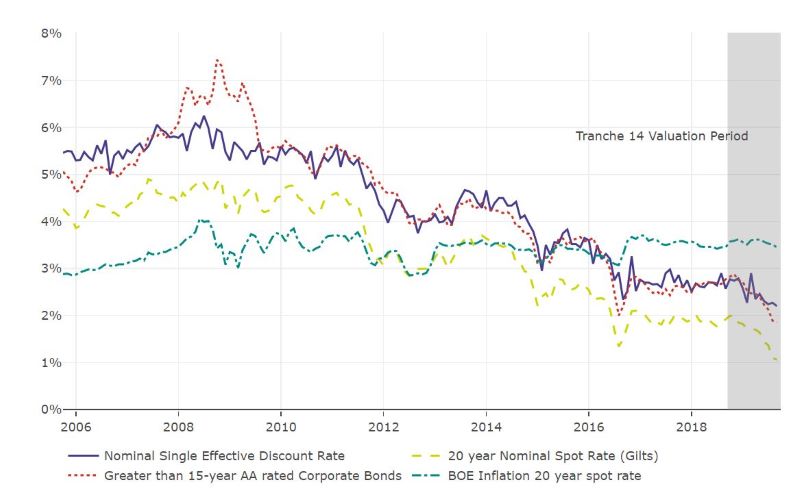

The 20-year nominal spot rate on gilts declined to 1.06% at the end of the tranche 14 valuation period. The gap between implied inflation and the nominal gilt yield, which had widened during the tranche 11 to tranche 14 inter-valuation period, kept real yields negative over the three-year period between most valuations.

For 31 December 2018 and 31 March 2019 (the two most common tranche 14 valuation dates), the 20-year spot rates on gilts were 1.87% and 1.62% respectively, while the corresponding median single effective discount rates (SEDR) for valuations were 2.58% and 2.35% respectively. The median SEDR fell below the rate of 20-year market implied inflation, relative to the position a year earlier.

Figure 10, below, shows the median SEDR relative to 20-year UK gilts, 20-year spot inflation, and greater than 15-year AA-rated corporate bonds (for schemes in deficit in tranches 1 to 7 and for all schemes in tranches 8 to 14).

Figure 10: Median (nominal) SEDR, Bank of England nominal gilts 20-year spot rate, greater than 15-year AA corporate bonds, and BOE 20-year inflation

Source(s): TPR, Thomson Reuters, Bank of England, Markit iBoxx

The average real SEDR is -1.04% for tranche 14, compared to 0.08% for tranche 11.

Schemes with a higher proportion of return-seeking assets tend, on average, to assume a higher discount rate. The implied level of outperformance over gilts in the discount rate appears to have an even stronger relationship to the proportion of return-seeking assets held by schemes, although there is a wide range of assumptions in discount rate outperformance among schemes with a similar allocation to return-seeking assets.

The average assumed return over nominal gilts is lower for tranche 14, compared to tranche 11. The average outperformance of the real SEDR over the 20-year real government spot rate is 0.87% for tranche 14, compared to 0.99% for tranche 11.

See table 4.2 in the annex for more information on discount rates

Life expectancies

While there were notable increases in average assumed life expectancies over the first three funding cycles, reflecting stronger mortality assumptions over that period, assumptions regarding average life expectancy are generally lower for tranche 14 schemes relative to tranches 11 and 8, for both future and current pensioners.

See tables 6.1 - 6.2 in the annex for more information on life expectancies

This reflects the general trend observed in the wider population over the last few years and that almost all schemes use the CMI mortality projection model when allowing for future improvements (see tables 5.1 - 5.4 in the annex).

In respect of the underlying mortality assumptions:

- 85% of tranche 14 schemes use the Self-Administered Pension Scheme (SAPS) tables

- 57% apply a scaling factor or rating to base tables to adjust for scheme experience

- 97% use the continuous mortality investigation (CMI) projection model (first published in 2009) to allow for future improvements

- while 86% of schemes assume a long-term rate of improvement/underpin of 1.5% or higher with 5% assuming a rate of 2% or higher

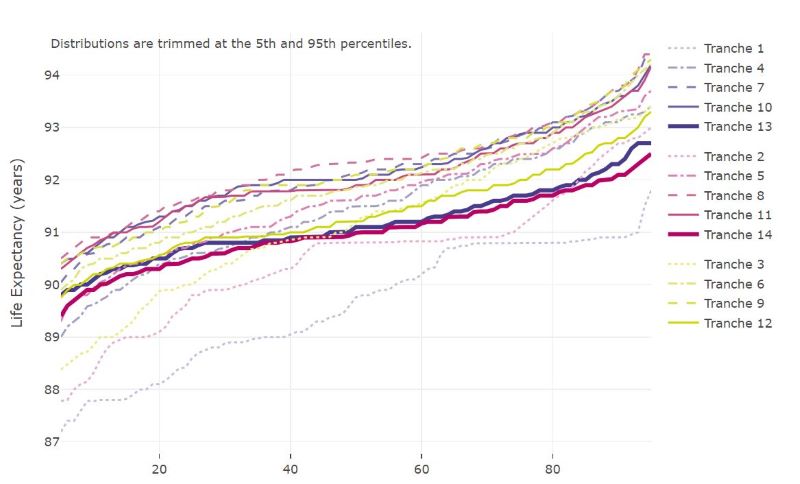

Figures 11a and 11b, below, show the distribution of assumed life expectancies for future male and female pensioners currently aged 45 respectively, for tranches 2, 5, 8, 11 and 14. Generally, tranche 14 life expectancy is at its lowest for both males and females since tranche 2.

Figure 11a: Distribution of life expectancy assumptions for future male pensioners currently aged 45 (all tranches)

Figure 11a: Distribution of life expectancy assumptions for future male pensioners currently aged 45

Source(s): TPR

Figure 11b: Distribution of life expectancy assumptions for future female pensioners currently aged 45 (all tranches)

Figure 11b: Distribution of life expectancy assumptions for future female pensioners currently aged 45 - click the tranche (grouped by cohort) in the figure legend to render

Source(s): TPR

Footnotes

- [1] Averages are unweighted unless stated otherwise.

- [2] Summary statistics in the body of the text may not match exactly those presented in the figures as the figures use trimmed distributions to mask outliers.

- [3] FTSE Russell Factsheet March 2019.

- [4] Summary statistics in the body of the text may not match exactly those presented in the figures as the figures use trimmed distributions to mask outliers.

- [5] Weighted by TPs.

- [6] Covenant Groups (1-4) are assigned at the point of initial RP reviews to facilitate prioritisation. These grades may vary to the view taken during case-level intervention, where a wider range of information is taken into account. They are defined as: Covenant Group 1 - strong; Covenant Group 2 - tending to strong; Covenant Group 3 - tending to weak; and, Covenant Group 4 - weak. Covenant assessments are not usually undertaken for schemes in surplus.

- [7] See previous footnote.

- [8] ‘Return-seeking assets’ in this report include equities, commodities, 60% of insurance policies, 75% of property, 80% of hedge funds, 25% of corporate bonds and assets held in the ‘other’ category.